JPMorgan Set to Pay More Than $900 Million in Fines - NYTimes.com

"JPMorgan Chase is expected to pay more than $900 million in fines to government authorities in Washington and London and make a rare admission of wrongdoing on Thursday, a pact that will settle a range of investigations over a multibillion trading blunder the bank suffered last year"

Wednesday, September 18, 2013

Tuesday, September 17, 2013

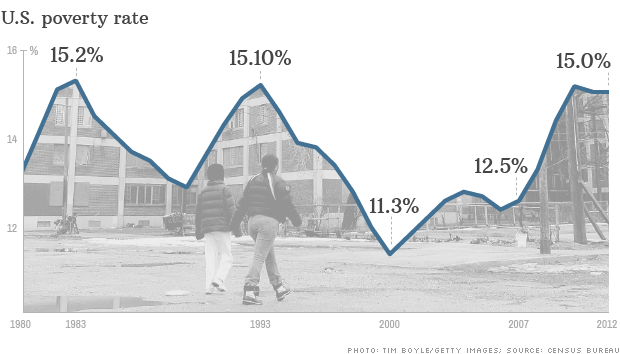

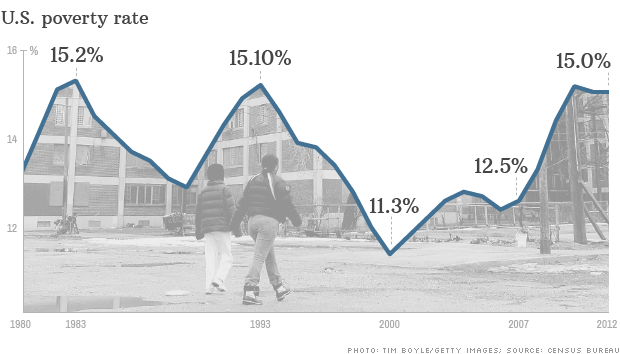

46.5 million Americans living in poverty

Poverty rate 15%

"Years after the Great Recession ended, 46.5 million Americans are still living in poverty, according to a Census Bureau report released Tuesday."

"But taking a wider view reveals a larger problem: Income has tumbled since the recession hit, and is still 8.3% below where it was in 2007."

"This long-term decline in income is troubling to economists, especially as the middle and lower classes have fared considerably worse than the rich. Since 1967, Americans right in the middle of the income curve have seen their earnings rise 19%, while those in the top 5% have seen a 67% gain. Rising inequality is seldom a sign of good social stability."

"The recession also pushed many more people into poverty. In 2010, the poverty rate peaked at 15.1%, and has barely fallen since then. This is the first time the poverty rate has remained at or above 15% three years running since 1965."

"Years after the Great Recession ended, 46.5 million Americans are still living in poverty, according to a Census Bureau report released Tuesday."

"But taking a wider view reveals a larger problem: Income has tumbled since the recession hit, and is still 8.3% below where it was in 2007."

"This long-term decline in income is troubling to economists, especially as the middle and lower classes have fared considerably worse than the rich. Since 1967, Americans right in the middle of the income curve have seen their earnings rise 19%, while those in the top 5% have seen a 67% gain. Rising inequality is seldom a sign of good social stability."

"The recession also pushed many more people into poverty. In 2010, the poverty rate peaked at 15.1%, and has barely fallen since then. This is the first time the poverty rate has remained at or above 15% three years running since 1965."

Sunday, September 15, 2013

How Goldman Sachs Made Money Mid-Crisis - Businessweek

How Goldman Sachs Made Money Mid-Crisis - Businessweek

"Of Lloyd Blankfein’s 3 hours and 28 minutes before the U.S. Senate’s permanent subcommittee on investigations on the afternoon of April 27, 2010, the most memorable moment came when Democratic Senator Carl Levin of Michigan, for the umpteenth time, held up an e-mail that had been written nearly three years earlier by two of Goldman Sachs’s (GS) most senior traders. The e-mail described a Goldman-underwritten collateralized-debt obligation, or CDO, as “one sh---y deal.” It was the end of a long day, and as Levin bore down on Blankfein, he wanted to know if it was ethical for Goldman to sell a security that its traders thought was bad while Goldman, as a principal, bet against those very same securities in order to make a profit.

It was not the chief executive officer’s finest response. He winced. He perseverated. He parsed. He looked uncomfortable. Finally, he lamely defended Goldman’s behavior. “In the context of market-making, that is not a conflict. What the clients are buying, or customers are buying, is—they are buying an exposure. The thing that we are selling to them is supposed to give them the risk they want.”

...

"..Goldman driving down the price for many illiquid and hard-to-value mortgage securities at a time when the firm had implemented its “big short”—thereby sticking it to those who were exposed. A range of Goldman’s counterparties, from Bear Stearns to American International Group (AIG), have argued subsequently that in 2007 Goldman began manipulating the price of these illiquid securities, knowing full well that it alone was in a position to benefit because of its short position. Competitors contend that Goldman’s marked-down prices exacerbated their financial problems by forcing them to lower the value of these securities on their books, vastly reducing their equity and calling into question their financial viability."

"Of Lloyd Blankfein’s 3 hours and 28 minutes before the U.S. Senate’s permanent subcommittee on investigations on the afternoon of April 27, 2010, the most memorable moment came when Democratic Senator Carl Levin of Michigan, for the umpteenth time, held up an e-mail that had been written nearly three years earlier by two of Goldman Sachs’s (GS) most senior traders. The e-mail described a Goldman-underwritten collateralized-debt obligation, or CDO, as “one sh---y deal.” It was the end of a long day, and as Levin bore down on Blankfein, he wanted to know if it was ethical for Goldman to sell a security that its traders thought was bad while Goldman, as a principal, bet against those very same securities in order to make a profit.

It was not the chief executive officer’s finest response. He winced. He perseverated. He parsed. He looked uncomfortable. Finally, he lamely defended Goldman’s behavior. “In the context of market-making, that is not a conflict. What the clients are buying, or customers are buying, is—they are buying an exposure. The thing that we are selling to them is supposed to give them the risk they want.”

...

"..Goldman driving down the price for many illiquid and hard-to-value mortgage securities at a time when the firm had implemented its “big short”—thereby sticking it to those who were exposed. A range of Goldman’s counterparties, from Bear Stearns to American International Group (AIG), have argued subsequently that in 2007 Goldman began manipulating the price of these illiquid securities, knowing full well that it alone was in a position to benefit because of its short position. Competitors contend that Goldman’s marked-down prices exacerbated their financial problems by forcing them to lower the value of these securities on their books, vastly reducing their equity and calling into question their financial viability."

Subscribe to:

Comments (Atom)