Credit Suisse to pay US$885m over bonds - Taipei Times

"Swiss bank Credit Suisse agreed on Friday to pay US$885 million to settle US charges it sold shoddy mortgage bonds to Fannie Mae and Freddie Mac ahead of the financial crisis.

Credit Suisse will pay about US$651 million to Fannie and US$234 million to Freddie, said the US Federal Housing Finance Agency (FHFA), the conservator of the two companies rescued by government during the 2008 financial crisis.

The FHFA said the settlement resolves all of its claims in two lawsuits against Credit Suisse.

The claims alleged that Credit Suisse misrepresented the quality of billions of dollars of mortgage-backed securities it sold to Freddie and Fannie during 2005 to 2007."

Saturday, March 22, 2014

Friday, March 21, 2014

U.S. schools plagued by inequality along racial lines, study finds

U.S. schools plagued by inequality along racial lines, study finds - latimes.com:

"Two-fifths of the nation's public school districts offer no preschool programs, and most of those that do offer only part-day programs. Black students account for less than a fifth of those in preschool across the nation but make up almost half of the students who are suspended from preschool multiple times.

Those results from the first comprehensive survey in nearly 15 years of civil rights data from the 97,000 U.S. public schools show they remain marked by inequities."

"Two-fifths of the nation's public school districts offer no preschool programs, and most of those that do offer only part-day programs. Black students account for less than a fifth of those in preschool across the nation but make up almost half of the students who are suspended from preschool multiple times.

Those results from the first comprehensive survey in nearly 15 years of civil rights data from the 97,000 U.S. public schools show they remain marked by inequities."

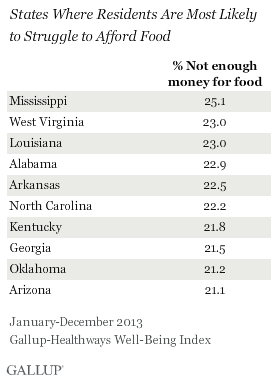

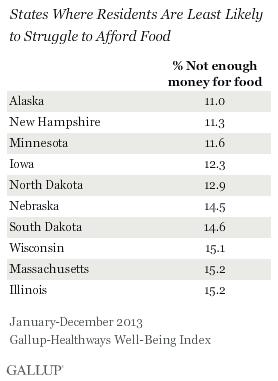

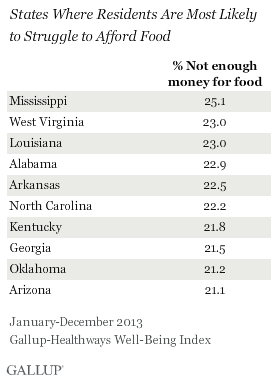

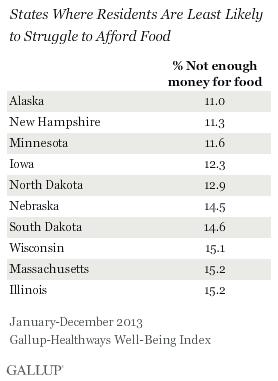

One in Four Mississippians' Struggled to Afford Food in 2013

One in Four Mississippians' Struggleed to Afford Food in 2013 _ Gallup:

"For the sixth consecutive year, Mississippians were the most likely in the U.S. to report struggling to afford food. In 2013, 25.1% report there was at least one time in the last 12 months when they did not have enough money to buy the food they or their families needed. Residents in West Virginia, Louisiana, and Alabama were also among the most likely to struggle to afford food. Residents of Alaska, New Hampshire, and Minnesota were among the least likely to have this problem."

"In 16 states, at least one in five residents said they struggled to afford the food that they or their families needed at least once in the past 12 months. In seven states, less than 15% of residents reported the same struggles in 2013."

"For the sixth consecutive year, Mississippians were the most likely in the U.S. to report struggling to afford food. In 2013, 25.1% report there was at least one time in the last 12 months when they did not have enough money to buy the food they or their families needed. Residents in West Virginia, Louisiana, and Alabama were also among the most likely to struggle to afford food. Residents of Alaska, New Hampshire, and Minnesota were among the least likely to have this problem."

"In 16 states, at least one in five residents said they struggled to afford the food that they or their families needed at least once in the past 12 months. In seven states, less than 15% of residents reported the same struggles in 2013."

Two-thirds of those who live paycheck to paycheck aren't poor, study finds

Two-thirds of those who live paycheck to paycheck aren't poor, study finds - MarketWatch

"It’s not just the poor who live paycheck to paycheck.

A study from Greg Kaplan and Justin Weidner of Princeton University and Giovanni Violante of New York University

finds that two-thirds of the 38 million American households who consume

all their disposable income every pay period aren’t poor.

The study, released at a Brookings Institution event, found that

these so-called wealthy-hand-to-mouth are older than their poor

paycheck-to-paycheck counterparts, have higher incomes (about $50,000)

and hold substantial illiquid assets (also around $50,000 on average),

like real estate. The poor who live paycheck to paycheck have median

incomes around $20,000.

However, these people only tend to stay in this situation for about

2.5 years, unlike the poor who tend to stay for long periods of time.

It’s not just a U.S. phenomenon: Canada, Australia, the U.K.,

Germany, France, Italy and Spain also have more non-poor

paycheck-to-paycheck households than poor ones, though the percentage

varies across countries.

The authors say the findings are important for policymakers when they craft stimulus programs.

The other finding that may be startling is that a third of all households do live paycheck to paycheck."

"It’s not just the poor who live paycheck to paycheck.

A study from Greg Kaplan and Justin Weidner of Princeton University and Giovanni Violante of New York University

finds that two-thirds of the 38 million American households who consume

all their disposable income every pay period aren’t poor.

The study, released at a Brookings Institution event, found that

these so-called wealthy-hand-to-mouth are older than their poor

paycheck-to-paycheck counterparts, have higher incomes (about $50,000)

and hold substantial illiquid assets (also around $50,000 on average),

like real estate. The poor who live paycheck to paycheck have median

incomes around $20,000.

However, these people only tend to stay in this situation for about

2.5 years, unlike the poor who tend to stay for long periods of time.

It’s not just a U.S. phenomenon: Canada, Australia, the U.K.,

Germany, France, Italy and Spain also have more non-poor

paycheck-to-paycheck households than poor ones, though the percentage

varies across countries.

The authors say the findings are important for policymakers when they craft stimulus programs.

The other finding that may be startling is that a third of all households do live paycheck to paycheck."

Wednesday, March 19, 2014

Big banks finish paying $20 billion in mortgage settlement

Big banks finish paying $20 billion in mortgage settlement, report says - The Washington Post:

"The nation’s largest banks have met their obligations to provide relief to struggling homeowners under the $25 billion national mortgage settlement, the landmark agreement to clean up shoddy foreclosure practices.

On Tuesday, the court-appointed monitor of the settlement said Bank of America, JPMorgan Chase, Wells Fargo, Citigroup and Ally Financial had all completed their requirements to offer various types of aid to borrowers, including allowing them to refinance or lowering the balance of their loan.

The mortgage servicers had to provide $20 billion in relief to

borrowers with different types of aid assigned different credit toward

that figure. While they ponied up a total of $50 billion to assist more

than 600,000 families, only $20.7 billion of that money was counted

under the settlement. "

"The nation’s largest banks have met their obligations to provide relief to struggling homeowners under the $25 billion national mortgage settlement, the landmark agreement to clean up shoddy foreclosure practices.

On Tuesday, the court-appointed monitor of the settlement said Bank of America, JPMorgan Chase, Wells Fargo, Citigroup and Ally Financial had all completed their requirements to offer various types of aid to borrowers, including allowing them to refinance or lowering the balance of their loan.

The mortgage servicers had to provide $20 billion in relief to

borrowers with different types of aid assigned different credit toward

that figure. While they ponied up a total of $50 billion to assist more

than 600,000 families, only $20.7 billion of that money was counted

under the settlement. "

Sunday, March 16, 2014

What the collapse of the Ming Dynasty can tell us about American decline

What the collapse of the Ming Dynasty can tell us about American decline - The Week

"Why did the Ming allow itself to become isolationist, stagnant, and

backward-looking? Historians are divided, but the leading explanation is

what historian Ian Morris calls the "paradox of development," and Mark

Elvin calls the "high-level equilibrium trap." Simply put, when a

country thinks it's in a golden age, it stops focusing on progress.

America shows signs of falling into this trap. We tell ourselves

robotically that we have "the best health-care system in the world,"

when in fact it underperforms most other rich countries. We gape and

gawk when we first travel to Japan or Switzerland and find that all the

trains run perfectly on time — not to mention the fact that there are

trains in the first place. We ignore our sky-high infrastructure costs

and grumble about potholed roads, never pausing to wonder why West

Europe and East Asia don't have these problems. We tell ourselves that

we're the "land of the free," ignoring the fact that in Japan you can

drink a beer in the park without getting arrested. We say that anyone in

America can get rich, ignoring the fact that economic mobility is lower

here than in almost any other rich country."

"Why did the Ming allow itself to become isolationist, stagnant, and

backward-looking? Historians are divided, but the leading explanation is

what historian Ian Morris calls the "paradox of development," and Mark

Elvin calls the "high-level equilibrium trap." Simply put, when a

country thinks it's in a golden age, it stops focusing on progress.

America shows signs of falling into this trap. We tell ourselves

robotically that we have "the best health-care system in the world,"

when in fact it underperforms most other rich countries. We gape and

gawk when we first travel to Japan or Switzerland and find that all the

trains run perfectly on time — not to mention the fact that there are

trains in the first place. We ignore our sky-high infrastructure costs

and grumble about potholed roads, never pausing to wonder why West

Europe and East Asia don't have these problems. We tell ourselves that

we're the "land of the free," ignoring the fact that in Japan you can

drink a beer in the park without getting arrested. We say that anyone in

America can get rich, ignoring the fact that economic mobility is lower

here than in almost any other rich country."

Subscribe to:

Comments (Atom)