The Great Voucher Fraud | Alternet

"Despite the best efforts of “school choice” advocates to spin the effectiveness of vouchers, decades of accumulated evidence paints a different story: Vouchers do not improve educational outcomes, they take money away from struggling public schools, they’re cash cows for institutions offering questionable education, they aid students already attending private institutions and they ignore the needs of special-education students."

"Voucher advocates have become adept at employing several lobbying arms, all of which have the ability to curry favor with certain types of legislators.

Powerful groups like the American Legislative Exchange Council, the Heritage Foundation, Betsy DeVos’ American Federation of Children and other far-right groups that hate public services provide a rich funding stream for the voucher movement.

Organizations like these talk about helping children. But their real goal is to crush teachers’ unions and shift education from the public to the private sector, opening up potentially billions for rapacious for-profit firms that would love nothing better than to “Walmart-ize” American education.

Joining them are fundamentalist Christians, who believe public education is “godless.” They seek tax support for their network of private independent schools, many of which teach Bible stories in place of science, offer discredited “Christian nation” views of history and are stridently anti-gay and anti-woman.

The Catholic bishops provide the final piece of the puzzle. Catholic schools have been in steep decline for decades, as more and more parents realize their children can get a good education in local public schools (schools that are free of the ultra-conservative dogma that saturates many Catholic institutions). Unable to control their unruly U.S. flock, the bishops are essentially seeking a taxpayer-funded bailout of a private school system that fewer and fewer Catholic parents see as necessary."

"

Consider Wisconsin’s private school voucher program, which at 23 years and counting makes it the oldest of its kind in the United States. In 2011, a study found that students participating in the Milwaukee Parental Choice Program scored proficient or advanced on standardized tests at a rate of 34.4 percent in math and 55.2 percent for reading, but students in Milwaukee Public Schools scored proficient or advanced at a rate of 47.8 percent in math and 59 percent in reading on the same assessments, according to the Wisconsin Department of Public Instruction.

The results have been equally unspectacular elsewhere. An analysis of Louisiana’s voucher program, released in May, found about 40 percent of third through eighth graders receiving vouchers scored at or above their grade level on statewide tests in English, math, social studies and science; by comparison, 69 percent of all third through eighth grade students statewide scored at or above grade level on those tests.

Likewise, a 2003 study of Cleveland’s then eight-year-old voucher scheme showed the program failed to boost the academic performance of the students taking part in it. The analysis, conducted by independent researcher Kim Metcalf of Indiana University, found that students participating in the program are doing no better academically than their public school counterparts."

"

Alan B. Krueger, a professor of economics and public policy, analyzed data presented in 2002 by Harvard University Professor of Government Paul E. Peterson, a voucher advocate, that found black students in the voucher schools scored 5.5 points higher on standardized tests than their counterparts in public schools.

Krueger’s own study of the data, however, showed no academic gains for African-American students in the voucher plan, reported Education Week. In analyzing the data, Krueger concluded that Peterson had erred by omitting too many children from the statistical sample. He also found that allowing a parent or guardian to state a child’s race led to children of mixed race being omitted from the sample when they should have been included. Including the omitted children, Krueger found a gain of only 1.44 percentile points on standardized tests, a figure that is not statistically significant."

Saturday, October 26, 2013

The Irony and Limits of the Affordable Care Act | Dissent Magazine

The Irony and Limits of the Affordable Care Act | Dissent Magazine

"A larger irony is that the ACA is about as far from a government takeover of health care or the “final leap to socialism” (as Michele Bachmann sees it) as one can imagine. Such hyperbole is now about a century old. In 1917 insurance executives raised the fear of “Prussian” or “Bolshevik” medicine. In the 1940s the American Medical Association fabricated a quote from Lenin—“socialized medicine is the keystone in the arch of the socialist state”—to punctuate its Cold War campaign against public health insurance. During the early debate over Medicare in 1961, Ronald Reagan warned that “you and I may well spend our sunset years telling our children and our children’s children what it once was like in America when men were free.” These scare tactics usually worked. The power of southern segregationists in Congress doomed much of the New Deal’s timid universalism. Deference to the AMA virtually immobilized health reform in the 1940s and 1950s. Job-based coverage emerged as the next-best bet, while public policy retreated to occasional efforts to mitigate its failures—most notably with the passage of Medicare and Medicaid in 1965. Since then efforts to appease health care industry interests and avoid the “socialized medicine” label have routinely turned good intentions into bad policy or legislative shipwrecks. Republican pollster Frank Luntz’s now-infamous 2009 memo “The Language of Healthcare” set out the basic talking points that would later pepper Ted Cruz’s filibuster: any public program or option is a slippery slope to “government takeover” and national health systems (insert Canadian or British horror story here) that stifle innovation, encourage malingering, and ration care—either by forcing patients to wait or by pulling the plug."

"In terms of coverage, efficiency, and equity, the ACA is a far cry from a single-payer system. Some hope that it might push us along that path (either through its sheer failure or by incremental tinkering with its provisions), and some fear that it might block the way (by marginalizing the remaining uninsured or simply poisoning the well for future reformers). In either case, the ACA is better than nothing and it has already had a real impact. Health care costs are falling. While slower spending is largely attributable to a slow recovery from a long recession, it also reflects the rollout of some of the ACA’s cost-containment provisions and the response of private insurers to the threat (and now the reality) of modest health reform. And the uninsured are finding coverage. Thanks to the ACA’s requirement that insurers allow children to stay on their parents’ plan until they are twenty-six, the uninsured rate among young adults has fallen for two consecutive years. None of the economic calamity predicted (or pined for) by congressional Republicans has come to pass. The law actually imposes little obligation, cost, or uncertainty on employers. Ninety four percent of firms affected by the ACA’s employer mandate already provide coverage voluntarily. There is no empirical evidence that the ACA is a “job killer” or that employers are gaming the mandate (now pushed off to 2014 anyway) by ducking under the fifty-worker threshold or cutting workers back to part-time status. The promise for the future is substantial. The combination of insurance regulations and state exchanges provides coverage options for millions of uninsured Americans. Most of those finding insurance via the ACA will qualify for subsidies that reduce the costs of that coverage. And the ACA will enhance the health security of those who are already covered by checking the capriciousness of private insurers and providing a softer landing for those who lose a job or job-based coverage."

"But let’s not get ahead of ourselves. In the rush to defend the ACA (and the larger ideal of a robust public sector) against the GOP’s suicide caucus, we are smearing a lot of lipstick on a pretty ugly pig. This is a timid law that will likely show timid results in the long run. Real health reform–like that proposed in 1948, 1965, 1972, and 1992—demands that we confront three problems studiously avoided (and in some respects made worse) by the ACA."

"At the root of our ongoing health crisis (both the unconscionable rate of uninsurance and a level of spending nearly double the OECD average) is our reliance on jobs as a means of distributing and paying for health coverage. This is an historical accident, which began as an ad hoc arrangement to evade Second World War-era wage and tax regulations by offering employees non-monetary compensation."

"The ACA’s second major flaw is its deference to the states on key aspects of eligibility and access....Despite the fact that the expansion will be paid for largely with federal dollars (full federal funding through 2016, no less than 90 percent after that), fully half of the states have passed on meaningful participation (twenty have turned the idea down flat and five more are undecided). Not surprisingly, the states that have thumbed their nose at the ACA are among the nation’s poorest and—with a midwestern inroad–closely follow the contours of the old Jim Crow South. According to a recent analysis by the New York Times, state-level recalcitrance will leave two-thirds of poor blacks, two-thirds of single mothers, and half of all uninsured low-wage workers ineligible for Medicaid and therefore unable to afford coverage offered by the insurance exchanges. This regional unevenness blunts the ACA’s impact by limiting its reach where is most needed. It leaves the fate of a federal law in the hands of fickle and deeply partisan state legislatures."

..."the ACA’s third major flaw: its inability or unwillingness to displace private insurance. In this respect, one baseline assumption of health reform has remained unchanged since the 1930s: we already pay for national health insurance, we just don’t get any of the benefits. As a consequence of incremental timidity, we spend as many public dollars on health care as any of our democratic and industrialized peers. We then spend as much again in private dollars–for a per capita bill more than double the OECD average—and claim precious little (widespread insecurity, lousy health outcomes, and high costs) in return."

" ...any reform that simply lards new coverage options onto the old system of private insurance will be hard pressed to realize any real efficiencies or savings in the long haul. Propping up the current health care system—or pushing more people into it via individual or employer mandates—does nothing to address the administrative waste, actuarial complexity, or naked profiteering that created our health care crisis in the first place."

"A larger irony is that the ACA is about as far from a government takeover of health care or the “final leap to socialism” (as Michele Bachmann sees it) as one can imagine. Such hyperbole is now about a century old. In 1917 insurance executives raised the fear of “Prussian” or “Bolshevik” medicine. In the 1940s the American Medical Association fabricated a quote from Lenin—“socialized medicine is the keystone in the arch of the socialist state”—to punctuate its Cold War campaign against public health insurance. During the early debate over Medicare in 1961, Ronald Reagan warned that “you and I may well spend our sunset years telling our children and our children’s children what it once was like in America when men were free.” These scare tactics usually worked. The power of southern segregationists in Congress doomed much of the New Deal’s timid universalism. Deference to the AMA virtually immobilized health reform in the 1940s and 1950s. Job-based coverage emerged as the next-best bet, while public policy retreated to occasional efforts to mitigate its failures—most notably with the passage of Medicare and Medicaid in 1965. Since then efforts to appease health care industry interests and avoid the “socialized medicine” label have routinely turned good intentions into bad policy or legislative shipwrecks. Republican pollster Frank Luntz’s now-infamous 2009 memo “The Language of Healthcare” set out the basic talking points that would later pepper Ted Cruz’s filibuster: any public program or option is a slippery slope to “government takeover” and national health systems (insert Canadian or British horror story here) that stifle innovation, encourage malingering, and ration care—either by forcing patients to wait or by pulling the plug."

"In terms of coverage, efficiency, and equity, the ACA is a far cry from a single-payer system. Some hope that it might push us along that path (either through its sheer failure or by incremental tinkering with its provisions), and some fear that it might block the way (by marginalizing the remaining uninsured or simply poisoning the well for future reformers). In either case, the ACA is better than nothing and it has already had a real impact. Health care costs are falling. While slower spending is largely attributable to a slow recovery from a long recession, it also reflects the rollout of some of the ACA’s cost-containment provisions and the response of private insurers to the threat (and now the reality) of modest health reform. And the uninsured are finding coverage. Thanks to the ACA’s requirement that insurers allow children to stay on their parents’ plan until they are twenty-six, the uninsured rate among young adults has fallen for two consecutive years. None of the economic calamity predicted (or pined for) by congressional Republicans has come to pass. The law actually imposes little obligation, cost, or uncertainty on employers. Ninety four percent of firms affected by the ACA’s employer mandate already provide coverage voluntarily. There is no empirical evidence that the ACA is a “job killer” or that employers are gaming the mandate (now pushed off to 2014 anyway) by ducking under the fifty-worker threshold or cutting workers back to part-time status. The promise for the future is substantial. The combination of insurance regulations and state exchanges provides coverage options for millions of uninsured Americans. Most of those finding insurance via the ACA will qualify for subsidies that reduce the costs of that coverage. And the ACA will enhance the health security of those who are already covered by checking the capriciousness of private insurers and providing a softer landing for those who lose a job or job-based coverage."

"At the root of our ongoing health crisis (both the unconscionable rate of uninsurance and a level of spending nearly double the OECD average) is our reliance on jobs as a means of distributing and paying for health coverage. This is an historical accident, which began as an ad hoc arrangement to evade Second World War-era wage and tax regulations by offering employees non-monetary compensation."

"The ACA’s second major flaw is its deference to the states on key aspects of eligibility and access....Despite the fact that the expansion will be paid for largely with federal dollars (full federal funding through 2016, no less than 90 percent after that), fully half of the states have passed on meaningful participation (twenty have turned the idea down flat and five more are undecided). Not surprisingly, the states that have thumbed their nose at the ACA are among the nation’s poorest and—with a midwestern inroad–closely follow the contours of the old Jim Crow South. According to a recent analysis by the New York Times, state-level recalcitrance will leave two-thirds of poor blacks, two-thirds of single mothers, and half of all uninsured low-wage workers ineligible for Medicaid and therefore unable to afford coverage offered by the insurance exchanges. This regional unevenness blunts the ACA’s impact by limiting its reach where is most needed. It leaves the fate of a federal law in the hands of fickle and deeply partisan state legislatures."

..."the ACA’s third major flaw: its inability or unwillingness to displace private insurance. In this respect, one baseline assumption of health reform has remained unchanged since the 1930s: we already pay for national health insurance, we just don’t get any of the benefits. As a consequence of incremental timidity, we spend as many public dollars on health care as any of our democratic and industrialized peers. We then spend as much again in private dollars–for a per capita bill more than double the OECD average—and claim precious little (widespread insecurity, lousy health outcomes, and high costs) in return."

" ...any reform that simply lards new coverage options onto the old system of private insurance will be hard pressed to realize any real efficiencies or savings in the long haul. Propping up the current health care system—or pushing more people into it via individual or employer mandates—does nothing to address the administrative waste, actuarial complexity, or naked profiteering that created our health care crisis in the first place."

Facebook Feminism, Like It or Not | Susan Faludi | The Baffler

Facebook Feminism, Like It or Not | Susan Faludi | The Baffler

"Since its unveiling this spring, the Lean In campaign has been reeling in a steadily expanding group of tens of thousands of followers with its tripartite E-Z plan for getting to the top. But the real foundation of the movement is, of course, Sheryl Sandberg’s bestselling book, Lean In: Women, Work, and the Will to Lead, billed modestly by its author as “sort of a feminist manifesto.” Sandberg’s mantra has become the feminist rallying cry of the moment, praised by notable figures such as Gloria Steinem, Jane Fonda, Marlo Thomas, and Nation columnist Katha Pollitt. A Time magazine cover story hails Sandberg for “embarking on the most ambitious mission to reboot feminism and reframe discussions of gender since the launch of Ms. magazine in 1971.” Pretty good for somebody who, “as of two and a half years ago,” as Sandberg confessed on her book tour, “had never said the word woman aloud. Because that’s not how you get ahead in the world.”

"Beneath highly manicured glam shots, each “member” or “partner” reveals her personal “Lean In moment.” The accounts inevitably have happy finales—the Lean In guidelines instruct contributors to “share a positive ending.” Tina Brown’s Lean In moment: getting her parents to move from England to “the apartment across the corridor from us on East 57th Street in New York,” so her mother could take care of the children while Brown took the helm at The New Yorker. If you were waiting for someone to lean in for child care legislation, keep holding your breath. So far, there’s no discernible groundswell."

"But there seems to be little tangible cross-class solidarity coming from the triumphalists, despite their claims to be speaking for all womankind. “If we can succeed in adding more female voices at the highest levels,” Sandberg writes in her book, “we will expand opportunities and extend fairer treatment to all.” But which highest-level voices? When former British prime minister Margaret (“I hate feminism”) Thatcher died, Lean In’s Facebook page paid homage to the Iron Lady and invited its followers to post “which moments were most memorable to you” from Thatcher’s tenure. That invitation inspired a rare outburst of un-“positive” remarks in the comment section, at least from some women in the U.K. “Really??” wrote one. “She was a tyrant. . . . Just because a woman is in a leadership position does not make her worthy of respect, especially if you were on the receiving end of what she did to lots of people.” “So disappointing that Lean In endorses Thatcher as a positive female role model,” wrote another. “She made history as a woman, but went on to use her power to work against the most vulnerable, including women and their children.”

"In the 1920s, male capitalists invoked feminism to advance their brands of corporate products. Nearly a century later, female marketers are invoking capitalism to advance their corporate brand of feminism. Sandberg’s “Lean In Community” is Exhibit A. What is she selling, after all, if not the product of the company she works for? Every time a woman signs up for Lean In, she’s made another conquest for Facebook. Facebook conquers women in more than one way. Nearly 60 percent of the people who do the daily labor on Facebook—maintaining their pages, posting their images, tagging their friends, driving the traffic—are female, and, unlike the old days of industrial textile manufacturing, they don’t even have to be paid or housed. “Facebook benefits every time a woman uploads her picture,” Kate Losse, a former employee of Facebook and author of The Boy Kings, a keenly observed memoir of her time there, pointed out to me. “And what is she getting? Nothing, except a constant flow of ‘likes.’”

"When asked about women’s representation at the company during media appearances for her book tour, Sandberg was vague. “We’re ahead of the industry,” she told one interviewer, noting that a woman heads Facebook’s “global sales” and another is “running design,” before briskly changing the subject."

"Since its unveiling this spring, the Lean In campaign has been reeling in a steadily expanding group of tens of thousands of followers with its tripartite E-Z plan for getting to the top. But the real foundation of the movement is, of course, Sheryl Sandberg’s bestselling book, Lean In: Women, Work, and the Will to Lead, billed modestly by its author as “sort of a feminist manifesto.” Sandberg’s mantra has become the feminist rallying cry of the moment, praised by notable figures such as Gloria Steinem, Jane Fonda, Marlo Thomas, and Nation columnist Katha Pollitt. A Time magazine cover story hails Sandberg for “embarking on the most ambitious mission to reboot feminism and reframe discussions of gender since the launch of Ms. magazine in 1971.” Pretty good for somebody who, “as of two and a half years ago,” as Sandberg confessed on her book tour, “had never said the word woman aloud. Because that’s not how you get ahead in the world.”

"Beneath highly manicured glam shots, each “member” or “partner” reveals her personal “Lean In moment.” The accounts inevitably have happy finales—the Lean In guidelines instruct contributors to “share a positive ending.” Tina Brown’s Lean In moment: getting her parents to move from England to “the apartment across the corridor from us on East 57th Street in New York,” so her mother could take care of the children while Brown took the helm at The New Yorker. If you were waiting for someone to lean in for child care legislation, keep holding your breath. So far, there’s no discernible groundswell."

"But there seems to be little tangible cross-class solidarity coming from the triumphalists, despite their claims to be speaking for all womankind. “If we can succeed in adding more female voices at the highest levels,” Sandberg writes in her book, “we will expand opportunities and extend fairer treatment to all.” But which highest-level voices? When former British prime minister Margaret (“I hate feminism”) Thatcher died, Lean In’s Facebook page paid homage to the Iron Lady and invited its followers to post “which moments were most memorable to you” from Thatcher’s tenure. That invitation inspired a rare outburst of un-“positive” remarks in the comment section, at least from some women in the U.K. “Really??” wrote one. “She was a tyrant. . . . Just because a woman is in a leadership position does not make her worthy of respect, especially if you were on the receiving end of what she did to lots of people.” “So disappointing that Lean In endorses Thatcher as a positive female role model,” wrote another. “She made history as a woman, but went on to use her power to work against the most vulnerable, including women and their children.”

"In the 1920s, male capitalists invoked feminism to advance their brands of corporate products. Nearly a century later, female marketers are invoking capitalism to advance their corporate brand of feminism. Sandberg’s “Lean In Community” is Exhibit A. What is she selling, after all, if not the product of the company she works for? Every time a woman signs up for Lean In, she’s made another conquest for Facebook. Facebook conquers women in more than one way. Nearly 60 percent of the people who do the daily labor on Facebook—maintaining their pages, posting their images, tagging their friends, driving the traffic—are female, and, unlike the old days of industrial textile manufacturing, they don’t even have to be paid or housed. “Facebook benefits every time a woman uploads her picture,” Kate Losse, a former employee of Facebook and author of The Boy Kings, a keenly observed memoir of her time there, pointed out to me. “And what is she getting? Nothing, except a constant flow of ‘likes.’”

Losse quit in 2010 to become a writer—of her own words, not her boss’s. Earlier this year, she wrote a thought-provoking piece about Lean In for Dissent, “Feminism’s Tipping Point: Who Wins from Leaning In?” The winners, she noted, are not the women in tech, who “are much more likely to be hired in support functions where they are paid a bare minimum, given tiny equity grants compared to engineers and executives, and given raises on the order of fifty cents an hour rather than thousands of dollars.” These are the fast-growth jobs for women in high technology, just as Menlo Park’s postindustrial campuses are the modern equivalent of the Lowell company town. Sandberg’s book proposed to remedy that system, Losse noted, not by changing it but simply by telling women to work harder:

Life is a race, Sandberg is telling us, and the way to win is through the perpetual acceleration of one’s own labor: moving forward, faster. The real antagonist identified by Lean In then is not institutionalized discrimination against women, but women’s reluctance to accept accelerating career demands.For her candor, Losse came under instant attack from the Sandberg sisterhood. Brandee Barker, a Lean In publicist and former head of public relations for Facebook, sent Losse the following message: “There’s a special place in hell for you.”

"When asked about women’s representation at the company during media appearances for her book tour, Sandberg was vague. “We’re ahead of the industry,” she told one interviewer, noting that a woman heads Facebook’s “global sales” and another is “running design,” before briskly changing the subject."

In U.S., Fewer Believe "Plenty of Opportunity" to Get Ahead

In U.S., Fewer Believe "Plenty of Opportunity" to Get Ahead

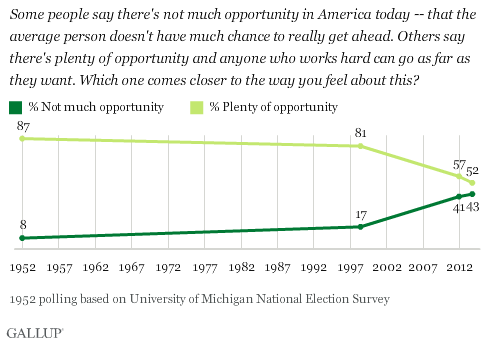

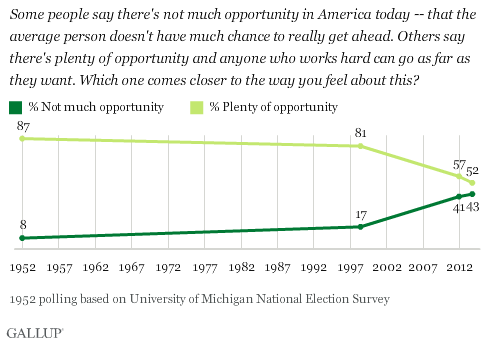

" Fewer Americans believe there is "plenty of opportunity" to get ahead in America today than have said so across three previous measurement points over the last 59 years. A bare majority (52%) say the country has plenty of economic opportunity, down from 57% in 2011 and more substantially from 81% in 1998."

" Fewer Americans believe there is "plenty of opportunity" to get ahead in America today than have said so across three previous measurement points over the last 59 years. A bare majority (52%) say the country has plenty of economic opportunity, down from 57% in 2011 and more substantially from 81% in 1998."

Thursday, October 24, 2013

'The Daily Show' and the Wall Street 'Witch Hunt' - NYTimes.com

'The Daily Show' and the Wall Street 'Witch Hunt' - NYTimes.com

I was wondering why nobody was taking on the sycophancy of the CNBC "financial journalists" to JPMorgan Chase CEO Jamie Dimon.

Until now.

Must watch!

Watch Jon Stewart tear down the argument that the Jamie Dimon was forced to buy Bear Sterns and Washington Mutual:

I was wondering why nobody was taking on the sycophancy of the CNBC "financial journalists" to JPMorgan Chase CEO Jamie Dimon.

Until now.

Must watch!

Watch Jon Stewart tear down the argument that the Jamie Dimon was forced to buy Bear Sterns and Washington Mutual:

Wednesday, October 23, 2013

The media can't stop sucking up to Alan Greenspan | New Republic

The media can't stop sucking up to Alan Greenspan | New Republic

"...anyone who’s paid attention to the economy the past few years knows how ridiculous it is to fete Greenspan, the main architect of the policies that led to the Great Recession. If we lived in a just world, we would put him on trial, not on television. And his penalty should be to scrounge up the funds to pay JPMorgan Chase’s $13 billion fine with the Justice Department."

"After all, that fine penalizes JPMorgan Chase for duping investors into purchasing mortgage-backed securities it knew were stuffed with garbage loans. And nobody in America duped more people—investors, homeowners, you name it—into buying bad loans than Alan Greenspan. While chairing the Fed, Greenspan was in a perfect position to inform Americans about the unsustainability of the housing bubble and the overall threats to the financial system. But his allergy to regulation and unshakeable belief in the virtues of the free market led him to ignore the bubble and its risks, infusing investors and consumers with confidence that the run-up in home prices was perfectly normal. If misleading the public about the safety and soundness of the housing market is a crime, Greenspan is guilty. And he deserves some manner of punishment for that, not a week full of deference and respect."

"...Greenspan willfully ignored the forces operating under his nose. He knew that brokers were selling not only ARMs, but no-documentation “liar’s loans” and other dodgy products to unsuspecting subprime borrowers. Fed Governor Edward Gramlich gave a speech on the challenges of subprime just three months after Greenspan encouraged everyone to go into adjustable-rate loans. By September of that year, the FBI warned of a mortgage fraud “epidemic,” particularly from this new breed of suspect mortgage brokers. Advisors warned him on multiple occasions to do something about the growing problem, to guard against overall risk and protect consumers from harm.

"...anyone who’s paid attention to the economy the past few years knows how ridiculous it is to fete Greenspan, the main architect of the policies that led to the Great Recession. If we lived in a just world, we would put him on trial, not on television. And his penalty should be to scrounge up the funds to pay JPMorgan Chase’s $13 billion fine with the Justice Department."

"After all, that fine penalizes JPMorgan Chase for duping investors into purchasing mortgage-backed securities it knew were stuffed with garbage loans. And nobody in America duped more people—investors, homeowners, you name it—into buying bad loans than Alan Greenspan. While chairing the Fed, Greenspan was in a perfect position to inform Americans about the unsustainability of the housing bubble and the overall threats to the financial system. But his allergy to regulation and unshakeable belief in the virtues of the free market led him to ignore the bubble and its risks, infusing investors and consumers with confidence that the run-up in home prices was perfectly normal. If misleading the public about the safety and soundness of the housing market is a crime, Greenspan is guilty. And he deserves some manner of punishment for that, not a week full of deference and respect."

"...Greenspan willfully ignored the forces operating under his nose. He knew that brokers were selling not only ARMs, but no-documentation “liar’s loans” and other dodgy products to unsuspecting subprime borrowers. Fed Governor Edward Gramlich gave a speech on the challenges of subprime just three months after Greenspan encouraged everyone to go into adjustable-rate loans. By September of that year, the FBI warned of a mortgage fraud “epidemic,” particularly from this new breed of suspect mortgage brokers. Advisors warned him on multiple occasions to do something about the growing problem, to guard against overall risk and protect consumers from harm.

But instead of tamping down the irrational exuberance in the housing markets, Greenspan encouraged homeowners to seek out precisely the types of products being fraudulently peddled by unscrupulous brokers. This fed the securitization machine and inflated the bubble. At the time, the Federal Reserve had consumer protection responsibilities for mortgages, but Greenspan did absolutely nothing to stop the rotten lending that would eventually implode the housing market. In addition, Greenspan lauded securitization in testimony before the Senate Banking Committee in 2005, saying it “does not create substantial systemic risks.” Only after he left the Fed, in 2008, did Greenspan decide that securitization was the culprit for the crisis. Greenspan pursued no regulatory avenues to deflate the bubble, nor did he bother to speak publicly about the dangers. Like a good Ayn Rand acolyte, Greenspan simply believed that lending institutions would act in their self-interest and never engage in destructive behavior. “Those of us who have looked to the self-interest of lending institutions to protect shareholders’ equity, myself included, are in a state of shocked disbelief,” Greenspan admitted to a House panel in 2008. That mea culpa was short-lived; he returns in his new book to an antipathy for regulation and a belief in the righteousness of the free market."

US CEOs break pay record as top 10 earners take home at least $100m each | Business | theguardian.com

US CEOs break pay record as top 10 earners take home at least $100m each

"For the first time ever, the 10 highest-paid chief executives in the US received more than $100m in compensation last year, and two took home billion-dollar paychecks, according to a leading annual survey of executive pay."

"All told, the top 10 CEOs in this year's poll took home over $4.7bn between them, and for the first time ever, none earned less than $100m.

"I have never seen anything like that," said Greg Ruel, GMI's senior research consultant and author of the report. "Usually we have a few CEOs at the $100m-plus level but never the entire top 10."

Father Seamus Finn, a corporate governance expert at Missionary Oblates of Mary Immaculate, said the numbers were "ridiculous".

"It's an amazing number. Who knows how compensation committees come up with them?"

Finn, who has campaigned against what he sees as excessive remuneration at companies including Goldman Sachs, said boards often argued that they would lose talent unless they paid top management huge sums.

"But I've seen no evidence of that," he said. "These huge pay deals are seldom linked to shareholder returns.""

"For the first time ever, the 10 highest-paid chief executives in the US received more than $100m in compensation last year, and two took home billion-dollar paychecks, according to a leading annual survey of executive pay."

"All told, the top 10 CEOs in this year's poll took home over $4.7bn between them, and for the first time ever, none earned less than $100m.

"I have never seen anything like that," said Greg Ruel, GMI's senior research consultant and author of the report. "Usually we have a few CEOs at the $100m-plus level but never the entire top 10."

Father Seamus Finn, a corporate governance expert at Missionary Oblates of Mary Immaculate, said the numbers were "ridiculous".

"It's an amazing number. Who knows how compensation committees come up with them?"

Finn, who has campaigned against what he sees as excessive remuneration at companies including Goldman Sachs, said boards often argued that they would lose talent unless they paid top management huge sums.

"But I've seen no evidence of that," he said. "These huge pay deals are seldom linked to shareholder returns.""

Sunday, October 20, 2013

4 in 5 in USA face near-poverty, no work

4 in 5 in USA face near-poverty, no work

"Four out of 5 U.S. adults struggle with joblessness, near-poverty or reliance on welfare for at least parts of their lives, a sign of deteriorating economic security and an elusive American dream."

"Hardship is particularly growing among whites, based on several measures. Pessimism among that racial group about their families' economic futures has climbed to the highest point since at least 1987. In the most recent AP-GfK poll, 63% of whites called the economy "poor.""

"The gauge defines "economic insecurity" as a year or more of periodic joblessness, reliance on government aid such as food stamps or income below 150% of the poverty line. Measured across all races, the risk of economic insecurity rises to 79%."

:

"Nationwide, the count of America's poor remains stuck at a record number: 46.2 million, or 15% of the population, due in part to lingering high unemployment following the recession. While poverty rates for blacks and Hispanics are nearly three times higher, by absolute numbers the predominant face of the poor is white.

More than 19 million whites fall below the poverty line of $23,021 for a family of four, accounting for more than 41% of the nation's destitute, nearly double the number of poor blacks."

"In 2011, that snapshot showed 12.6% of adults in their prime working-age years of 25-60 lived in poverty. But measured in terms of a person's lifetime risk, a much higher number — 4 in 10 adults — falls into poverty for at least a year of their lives.

The risks of poverty also have been increasing in recent decades, particularly among people ages 35-55, coinciding with widening income inequality. For instance, people ages 35-45 had a 17% risk of encountering poverty during the 1969-1989 time period; that risk increased to 23% during the 1989-2009 period. For those ages 45-55, the risk of poverty jumped from 11.8% to 17.7%.

Higher recent rates of unemployment mean the lifetime risk of experiencing economic insecurity now runs even higher: 79%, or 4 in 5 adults, by the time they turn 60.

By race, nonwhites still have a higher risk of being economically insecure, at 90 percent. But compared with the official poverty rate, some of the biggest jumps under the newer measure are among whites, with more than 76% enduring periods of joblessness, life on welfare or near-poverty.

By 2030, based on the current trend of widening income inequality, close to 85% of all working-age adults in the U.S. will experience bouts of economic insecurity."

"Four out of 5 U.S. adults struggle with joblessness, near-poverty or reliance on welfare for at least parts of their lives, a sign of deteriorating economic security and an elusive American dream."

"Hardship is particularly growing among whites, based on several measures. Pessimism among that racial group about their families' economic futures has climbed to the highest point since at least 1987. In the most recent AP-GfK poll, 63% of whites called the economy "poor.""

"The gauge defines "economic insecurity" as a year or more of periodic joblessness, reliance on government aid such as food stamps or income below 150% of the poverty line. Measured across all races, the risk of economic insecurity rises to 79%."

:

"Nationwide, the count of America's poor remains stuck at a record number: 46.2 million, or 15% of the population, due in part to lingering high unemployment following the recession. While poverty rates for blacks and Hispanics are nearly three times higher, by absolute numbers the predominant face of the poor is white.

More than 19 million whites fall below the poverty line of $23,021 for a family of four, accounting for more than 41% of the nation's destitute, nearly double the number of poor blacks."

"In 2011, that snapshot showed 12.6% of adults in their prime working-age years of 25-60 lived in poverty. But measured in terms of a person's lifetime risk, a much higher number — 4 in 10 adults — falls into poverty for at least a year of their lives.

The risks of poverty also have been increasing in recent decades, particularly among people ages 35-55, coinciding with widening income inequality. For instance, people ages 35-45 had a 17% risk of encountering poverty during the 1969-1989 time period; that risk increased to 23% during the 1989-2009 period. For those ages 45-55, the risk of poverty jumped from 11.8% to 17.7%.

Higher recent rates of unemployment mean the lifetime risk of experiencing economic insecurity now runs even higher: 79%, or 4 in 5 adults, by the time they turn 60.

By race, nonwhites still have a higher risk of being economically insecure, at 90 percent. But compared with the official poverty rate, some of the biggest jumps under the newer measure are among whites, with more than 76% enduring periods of joblessness, life on welfare or near-poverty.

By 2030, based on the current trend of widening income inequality, close to 85% of all working-age adults in the U.S. will experience bouts of economic insecurity."

HSBC hit with $2.46-billion judgment in U.S. class action | Reuters

HSBC hit with $2.46-billion judgment in U.S. class action | Reuters

"A unit of British bank HSBC Holdings Plc (HSBA.L) was hit with a record $2.46 billion final judgment in a U.S. securities class action lawsuit against its unit, formerly known as Household International Inc."

"The suit was filed in 2002 and alleged that Household International had violated securities laws by fraudulently misleading investors about the quality of its loans."

"A unit of British bank HSBC Holdings Plc (HSBA.L) was hit with a record $2.46 billion final judgment in a U.S. securities class action lawsuit against its unit, formerly known as Household International Inc."

"The suit was filed in 2002 and alleged that Household International had violated securities laws by fraudulently misleading investors about the quality of its loans."

JPMorgan Said Reach Record $13 Billion U.S. Settlement - Bloomberg

JPMorgan Said Reach Record $13 Billion U.S. Settlement - Bloomberg

"The tentative pact with the Department of Justice increased from an $11 billion proposal last month and would mark the largest amount paid by a financial firm in a settlement with the U.S. The deal wouldn’t release the bank from potential criminal liability, at the insistence of U.S. Attorney General Eric Holder, according to terms described by a person familiar with the talks, who asked not to be named because they were private."

"The agreement, which isn’t yet final, includes $4 billion in relief for unspecified consumers and $9 billion in payments and fines"

"The FHFA accused JPMorgan and its affiliates of making false statements and omitting material facts in selling $33 billion in mortgage bonds to Fannie Mae and Freddie Mac from Sept. 7, 2005, through Sept. 19, 2007. Those two firms, regulated by FHFA, have taken $187.5 billion in federal aid since then.

The regulator said executives at JPMorgan, Washington Mutual and Bear Stearns Cos., which were acquired by JPMorgan in 2008, knowingly misrepresented the quality of the loans underlying the bonds, according to the lawsuit filed in federal court in Manhattan."

"JPMorgan has paid more than $1 billion to five different regulators in the past month to settle probes into botched derivatives trades that lost more than $6.2 billion in 2012. It also settled unrelated claims it unfairly charged customers for credit-monitoring products.

The bank faces an investigation into its hiring practices in Asia. It’s also the subject of a probe by Manhattan U.S. Attorney Preet Bharara into claims it abetted Bernard Madoff’s Ponzi scheme, a person familiar with that matter said.

The six biggest U.S. banks, led by JPMorgan and Charlotte, North Carolina-based Bank of America Corp., have piled up more than $100 billion in legal costs since the financial crisis, a figure that exceeds all of the dividends paid to shareholders in the past five years, Bloomberg data show."

"The tentative pact with the Department of Justice increased from an $11 billion proposal last month and would mark the largest amount paid by a financial firm in a settlement with the U.S. The deal wouldn’t release the bank from potential criminal liability, at the insistence of U.S. Attorney General Eric Holder, according to terms described by a person familiar with the talks, who asked not to be named because they were private."

"The agreement, which isn’t yet final, includes $4 billion in relief for unspecified consumers and $9 billion in payments and fines"

"The FHFA accused JPMorgan and its affiliates of making false statements and omitting material facts in selling $33 billion in mortgage bonds to Fannie Mae and Freddie Mac from Sept. 7, 2005, through Sept. 19, 2007. Those two firms, regulated by FHFA, have taken $187.5 billion in federal aid since then.

The regulator said executives at JPMorgan, Washington Mutual and Bear Stearns Cos., which were acquired by JPMorgan in 2008, knowingly misrepresented the quality of the loans underlying the bonds, according to the lawsuit filed in federal court in Manhattan."

"JPMorgan has paid more than $1 billion to five different regulators in the past month to settle probes into botched derivatives trades that lost more than $6.2 billion in 2012. It also settled unrelated claims it unfairly charged customers for credit-monitoring products.

The bank faces an investigation into its hiring practices in Asia. It’s also the subject of a probe by Manhattan U.S. Attorney Preet Bharara into claims it abetted Bernard Madoff’s Ponzi scheme, a person familiar with that matter said.

The six biggest U.S. banks, led by JPMorgan and Charlotte, North Carolina-based Bank of America Corp., have piled up more than $100 billion in legal costs since the financial crisis, a figure that exceeds all of the dividends paid to shareholders in the past five years, Bloomberg data show."

Subscribe to:

Comments (Atom)