Obama and Climate Change: The Real Story - Rolling Stone

"If you want to understand how people will remember the Obama climate legacy, a few facts tell the tale: By the time Obama leaves office, the U.S. will pass Saudi Arabia as the planet's biggest oil producer and Russia as the world's biggest producer of oil and gas combined. In the same years, even as we've begun to burn less coal at home, our coal exports have climbed to record highs. We are, despite slight declines in our domestic emissions, a global-warming machine: At the moment when physics tell us we should be jamming on the carbon brakes, America is revving the engine."

Tuesday, December 31, 2013

Monday, December 30, 2013

Wells Fargo settles with Fannie Mae for $591 million | Real Estate | NewsObserver.com

Wells Fargo settles with Fannie Mae for $591 million - NewsObserver.com

"Wells Fargo will pay more than half a billion dollars to mortgage giant Fannie Mae to settle a disagreement over bad loans sold by the bank before the financial crisis.

The San Francisco bank announced Monday that it had reached a $591 million agreement with Fannie Mae to cover all mortgages sold before 2009. After the mortgages went sour, Fannie Mae sought to force Wells Fargo to buy them back, claiming their quality was misrepresented."

"The agreement with Wells Fargo marks the latest in a string of settlements between major banks, Fannie Mae and the government regulator that oversees Fannie, the Federal Housing Finance Agency.

Nearly a year ago, Charlotte-based Bank of America agreed to pay $10 billion to settle claims with Fannie Mae. The deal included $3.6 billion in cash and required the repurchase of more than 30,000 loans.

Fannie has also entered into similar agreements with SunTrust Banks, CitiMortgage, J.P. Morgan Chase, Flagstar, PNC and HSBC Bank in settlements that totaled a combined $2.36 billion."

"Wells Fargo will pay more than half a billion dollars to mortgage giant Fannie Mae to settle a disagreement over bad loans sold by the bank before the financial crisis.

The San Francisco bank announced Monday that it had reached a $591 million agreement with Fannie Mae to cover all mortgages sold before 2009. After the mortgages went sour, Fannie Mae sought to force Wells Fargo to buy them back, claiming their quality was misrepresented."

"The agreement with Wells Fargo marks the latest in a string of settlements between major banks, Fannie Mae and the government regulator that oversees Fannie, the Federal Housing Finance Agency.

Nearly a year ago, Charlotte-based Bank of America agreed to pay $10 billion to settle claims with Fannie Mae. The deal included $3.6 billion in cash and required the repurchase of more than 30,000 loans.

Fannie has also entered into similar agreements with SunTrust Banks, CitiMortgage, J.P. Morgan Chase, Flagstar, PNC and HSBC Bank in settlements that totaled a combined $2.36 billion."

Thursday, December 26, 2013

$1B/year climate denial network exposed - Boing Boing

$1B/year climate denial network exposed - Boing Boing:

"In Institutionalizing delay: foundation funding and the creation of U.S. climate change counter-movement organizations, a scholarly article published in the current Climatic Change , Drexel University's Robert J. Brulle documents a billion-dollar-per-year climate-change denial network, underwritten by conservative billionaires operating through obfuscating networks of companies aimed at obscuring the origin of the funds."

"In Institutionalizing delay: foundation funding and the creation of U.S. climate change counter-movement organizations, a scholarly article published in the current Climatic Change , Drexel University's Robert J. Brulle documents a billion-dollar-per-year climate-change denial network, underwritten by conservative billionaires operating through obfuscating networks of companies aimed at obscuring the origin of the funds."

Saturday, December 21, 2013

Deutsche Bank to pay $1.9 billion over mortgage securities - Business - The Boston Globe

Deutsche Bank to pay $1.9 billion over mortgage securities - The Boston Globe

"Deutsche Bank agreed Friday to pay about $1.9 billion to settle claims that it had misled Fannie Mae and Freddie Mac over the quality of home loans bundled into mortgage-backed securities, becoming the latest big bank to reach a settlement with federal housing regulators.

The bank, based in Germany, is the sixth entity to reach a settlement with the Federal Housing Finance Agency, which had sued 18 banks and financial institutions in September 2011. The agency says the institutions misled Fannie and Freddie before the financial crisis over the creditworthiness of borrowers and the quality of the loans that were packaged into securities. The agency is seeking to recoup some of $196 billion that Fannie and Freddie had spent buying up the private-label mortgage-backed securities."

"Deutsche Bank agreed Friday to pay about $1.9 billion to settle claims that it had misled Fannie Mae and Freddie Mac over the quality of home loans bundled into mortgage-backed securities, becoming the latest big bank to reach a settlement with federal housing regulators.

The bank, based in Germany, is the sixth entity to reach a settlement with the Federal Housing Finance Agency, which had sued 18 banks and financial institutions in September 2011. The agency says the institutions misled Fannie and Freddie before the financial crisis over the creditworthiness of borrowers and the quality of the loans that were packaged into securities. The agency is seeking to recoup some of $196 billion that Fannie and Freddie had spent buying up the private-label mortgage-backed securities."

Thursday, December 19, 2013

Mortgage Applications Collapse To New 13-Year Low | Zero Hedge

Mortgage Applications Collapse To New 13-Year Low | Zero Hedge

New 13-year lows in mortgage applications...

but, hey, seasonally-adjusted we'll just keep building...

New 13-year lows in mortgage applications...

but, hey, seasonally-adjusted we'll just keep building...

Saturday, December 14, 2013

Madoff: I helped feds nab JPMorgan | New York Post

Madoff: I helped feds nab JPMorgan | New York Post

"Bernie Madoff, one of the world’s most reviled fraudsters, helped regulators ding JPMorgan Chase.

The 75-year-old felon boasted in an email made public Friday that he provided “key information” to the Treasury’s Inspector General’s office that, presumably, was relayed up the chain of command and eventually used by Manhattan prosecutors in their expected $2 billion criminal action against the bank."

"JPMorgan was Madoff’s primary bank for more than 20 years.

On Dec. 11, it was learned that JPMorgan could face as much as $2 billion in penalties from a criminal action brought by Manhattan US Attorney Preet Bharara for willfully turning a blind eye to Madoff’s scam.

JPMorgan is one of a number of banks, including HSBC and UBS, ensnared in government probes over their roles in the massive fraud, sources point out."

"Bernie Madoff, one of the world’s most reviled fraudsters, helped regulators ding JPMorgan Chase.

The 75-year-old felon boasted in an email made public Friday that he provided “key information” to the Treasury’s Inspector General’s office that, presumably, was relayed up the chain of command and eventually used by Manhattan prosecutors in their expected $2 billion criminal action against the bank."

"JPMorgan was Madoff’s primary bank for more than 20 years.

On Dec. 11, it was learned that JPMorgan could face as much as $2 billion in penalties from a criminal action brought by Manhattan US Attorney Preet Bharara for willfully turning a blind eye to Madoff’s scam.

JPMorgan is one of a number of banks, including HSBC and UBS, ensnared in government probes over their roles in the massive fraud, sources point out."

Wednesday, December 04, 2013

Europe Sets Big Fines in Settling Libor Case - NYTimes.com

Europe Sets Big Fines in Settling Libor Case - NYTimes.com

The settlement was the largest combined penalty ever levied by the European competition authorities and is the first time that American banks have been fined in a set of interest rate scandals that have also drawn scrutiny from regulators in Britain and United States. Those regulators still have their own investigations underway.

The settlement was the largest combined penalty ever levied by the European competition authorities and is the first time that American banks have been fined in a set of interest rate scandals that have also drawn scrutiny from regulators in Britain and United States. Those regulators still have their own investigations underway.

Thursday, November 28, 2013

Bill Gates Imposes Microsoft Model on School Reform: Only to Have the Company Junk It After It Failed | Alternet

Bill Gates Imposes Microsoft Model on School Reform: Only to Have the Company Junk It After It Failed | Alternet

"Schools have a lot to learn from business about how to improve performance, Bill Gates declared in an op-ed in the Wall Street Journal in 2011. He pointed to his own company as a worthy model for public schools.

“At Microsoft, we believed in giving our employees the best chance to succeed, and then we insisted on success. We measured excellence, rewarded those who achieved it and were candid with those who did not.”

Adopting the Microsoft model means public schools grading teachers, rewarding the best and being “candid”—that is, firing those who are deemed ineffective. "If you do that,” Gates promised Oprah Winfrey, “then we go from being basically at the bottom of the rich countries to being back at the top."

The Microsoft model, called “stacked ranking,” forced every work unit to declare a certain percentage of employees as top performers, then good performers, then average, then below average, then poor.

Using hundred of millions of dollars in philanthropic largesse, Bill Gates persuaded state and federal policymakers that what was good for Microsoft would be good for the public schools system (to be sure, he was pushing against an open door). To be eligible for large grants from President Obama’s Race to the Top program, for example, states had to adopt Gates’ Darwinian approach to improving public education. Today more than 36 states have altered their teacher evaluations systems with the aim of weeding out the worst and rewarding the best."

"This month Microsoft abandoned the hated system.

On November 12, all Microsoft employees received a memo from Lisa Brummel, executive vice-president for human resources, announcingthe company will be adopting “a fundamentally new approach to performance and development designed to promote new levels of teamwork and agility for breakthrough business impact.”

Brummel listed four key elements in the company’s new policy.

More emphasis on teamwork and collaboration.

More emphasis on employee growth and development.

No more use of a Bell curve for evaluating employees.

No more ratings of employees."

On November 12, all Microsoft employees received a memo from Lisa Brummel, executive vice-president for human resources, announcingthe company will be adopting “a fundamentally new approach to performance and development designed to promote new levels of teamwork and agility for breakthrough business impact.”

Brummel listed four key elements in the company’s new policy.

More emphasis on teamwork and collaboration.

More emphasis on employee growth and development.

No more use of a Bell curve for evaluating employees.

No more ratings of employees."

Wednesday, November 20, 2013

JPMorgan and Uncle Sam Now Partners in Pillaging of America: Ritholtz | Breakout - Yahoo Finance

JPMorgan and Uncle Sam Now Partners in Pillaging of America: Ritholtz - Yahoo Finance

"It's really about $2 or $3 billion if you back out various components," says Barry Ritholtz ofRitholtz Wealth Management. It's not clear exactly how the money will be distributed, but based on the details from the previously announced $4 billion settlement between JPMorgan, the Justice Department, and U.S. Department of Housing and Urban Development, it illustrates the squishy nature of the punishment. That $4 billion, which is included in the $13 billion being bandied about, includes $1.5 billion in loan forgiveness and $500 million in mortgage adjustments. JPMorgan was unlikely to see much if any of this $2 billion with or without a deal."

"Stranger still is the remaining $2 billion being split between giving JPMorgan credit for demolishing abandoned houses and issuing new loans for low and moderate income income borrowers. In other words, JPMorgan is going to be forced to do more business with high-risk borrowers as punishment for offering mortgages for unqualified would-be homeowners.

"It's really about $2 or $3 billion if you back out various components," says Barry Ritholtz ofRitholtz Wealth Management. It's not clear exactly how the money will be distributed, but based on the details from the previously announced $4 billion settlement between JPMorgan, the Justice Department, and U.S. Department of Housing and Urban Development, it illustrates the squishy nature of the punishment. That $4 billion, which is included in the $13 billion being bandied about, includes $1.5 billion in loan forgiveness and $500 million in mortgage adjustments. JPMorgan was unlikely to see much if any of this $2 billion with or without a deal."

"Stranger still is the remaining $2 billion being split between giving JPMorgan credit for demolishing abandoned houses and issuing new loans for low and moderate income income borrowers. In other words, JPMorgan is going to be forced to do more business with high-risk borrowers as punishment for offering mortgages for unqualified would-be homeowners.

The Justice Department reserves the right to pursue criminal charges against bank officials, but the clock is ticking on the statute of limitations. Ritholtz says the absence of a credible threat regarding criminal charges all but legitimizes the settlement as a one-off charge in business as usual for JPMorgan.

Ritholtz draws a parellel to the settlement and the reltationship between a gambler and a bookie. The message according to Ritholtz is that "Uncle Sam is now your partner. You're going to have to cut off a little vig to the Fed, but you still get to rape and pillage."

Even pro-business Swiss look at limiting CEO pay - Matthew Lynn's London Eye - MarketWatch

Even pro-business Swiss look at limiting CEO pay - MarketWatch

"On Sunday, Switzerland will hold a referendum that if passed, would force companies to limit the highest salary they pay to 12 times the lowest. According to the polls, the vote is on a knife-edge and could easily go either way. Business groups are issuing the predictable dire warnings about an exodus of managerial talent if the law gets passed , with dire consequences for the giants of Swiss industry."

"On Sunday, Switzerland will hold a referendum that if passed, would force companies to limit the highest salary they pay to 12 times the lowest. According to the polls, the vote is on a knife-edge and could easily go either way. Business groups are issuing the predictable dire warnings about an exodus of managerial talent if the law gets passed , with dire consequences for the giants of Swiss industry."

"But, in fact, the Swiss might be doing a world a favor. The gap between what the people running companies and the people working for them earn has exploded. And yet there is very little evidence that companies are better run, or more productive, or make more money for their shareholders, as a result. If the Swiss call time on what looks increasingly like a racket, they may well set a useful example for the rest of the world.

Switzerland is no one’s idea of a radical nation. A more sober, right-wing, low-tax and small-government country it would be hard to imagine."

Tuesday, November 19, 2013

How Munich rejected Steve Ballmer and kicked Microsoft out of the city - Feature - TechRepublic

How Munich rejected Steve Ballmer and kicked Microsoft out of the city - TechRepublic

"Munich says the move to open source has saved it more than €10m, a claim contested by Microsoft, yet .. the point of making the switch was never about money, but about freedom."

"If you are only doing a migration because you think it saves you money there's always somebody who tells you afterwards that you didn't calculate it properly," ..

"Munich says the move to open source has saved it more than €10m, a claim contested by Microsoft, yet .. the point of making the switch was never about money, but about freedom."

"If you are only doing a migration because you think it saves you money there's always somebody who tells you afterwards that you didn't calculate it properly," ..

Sunday, November 17, 2013

This Man Was Sentenced to Die in Prison for Shoplifting a $159 Jacket: This Happens More Than You Think | Alternet

This Man Was Sentenced to Die in Prison for Shoplifting a $159 Jacket: This happens more than you think - Alternet

"At about 12.40pm on 2 January 1996, Timothy Jackson took a jacket from the Maison Blanche department store in New Orleans, draped it over his arm, and walked out of the store without paying for it. When he was accosted by a security guard, Jackson said: “I just needed another jacket, man.”

A few months later Jackson was convicted of shoplifting and sent to Angola prison in Louisiana. That was 16 years ago. Today he is still incarcerated in Angola, and will stay there for the rest of his natural life having been condemned to die in jail. All for the theft of a jacket, worth $159.

Jackson, 53, is one of 3,281 prisoners in America serving life sentences with no chance of parole for non-violent crimes. Some, like him, were given the most extreme punishment short of execution for shoplifting; one was condemned to die in prison for siphoning petrol from a truck; another for stealing tools from a tool shed; yet another for attempting to cash a stolen cheque."

"The ACLU's report, A Living Death, chronicles the thousands of lives ruined and families destroyed by the modern phenomenon of sentencing people to die behind bars for non-violent offences. It notes that contrary to the expectation that such a harsh penalty would be meted out only to the most serious offenders, people have been caught in this brutal trap for sometimes the most petty causes.

Ronald Washington, 48, is also serving life without parole in Angola, in his case for shoplifting two Michael Jordan jerseys from a Foot Action sportswear store in Shreveport, Louisiana, in 2004. Washington insisted at trial that the jerseys were reduced in a sale to $45 each – which meant that their combined value was below the $100 needed to classify the theft as a felony; the prosecution disagreed, claiming they were on sale for $60 each, thus surpassing the $100 felony minimum and opening him up to a sentence of life without parole."

"Until the early 1970s, life without parole sentences were virtually unknown. But they exploded as part of what the ACLU calls America's “late-twentieth-century obsession with mass incarceration and extreme, inhumane penalties.”

The report's author Jennifer Turner states that today, the US is “virtually alone in its willingness to sentence non-violent offenders to die behind bars.” Life without parole for non-violent sentences has been ruled a violation of human rights by the European Court of Human Rights. The UK is one of only two countries in Europe that still metes out the penalty at all, and even then only in 49 cases of murder."

"At about 12.40pm on 2 January 1996, Timothy Jackson took a jacket from the Maison Blanche department store in New Orleans, draped it over his arm, and walked out of the store without paying for it. When he was accosted by a security guard, Jackson said: “I just needed another jacket, man.”

A few months later Jackson was convicted of shoplifting and sent to Angola prison in Louisiana. That was 16 years ago. Today he is still incarcerated in Angola, and will stay there for the rest of his natural life having been condemned to die in jail. All for the theft of a jacket, worth $159.

Jackson, 53, is one of 3,281 prisoners in America serving life sentences with no chance of parole for non-violent crimes. Some, like him, were given the most extreme punishment short of execution for shoplifting; one was condemned to die in prison for siphoning petrol from a truck; another for stealing tools from a tool shed; yet another for attempting to cash a stolen cheque."

"The ACLU's report, A Living Death, chronicles the thousands of lives ruined and families destroyed by the modern phenomenon of sentencing people to die behind bars for non-violent offences. It notes that contrary to the expectation that such a harsh penalty would be meted out only to the most serious offenders, people have been caught in this brutal trap for sometimes the most petty causes.

Ronald Washington, 48, is also serving life without parole in Angola, in his case for shoplifting two Michael Jordan jerseys from a Foot Action sportswear store in Shreveport, Louisiana, in 2004. Washington insisted at trial that the jerseys were reduced in a sale to $45 each – which meant that their combined value was below the $100 needed to classify the theft as a felony; the prosecution disagreed, claiming they were on sale for $60 each, thus surpassing the $100 felony minimum and opening him up to a sentence of life without parole."

"Until the early 1970s, life without parole sentences were virtually unknown. But they exploded as part of what the ACLU calls America's “late-twentieth-century obsession with mass incarceration and extreme, inhumane penalties.”

The report's author Jennifer Turner states that today, the US is “virtually alone in its willingness to sentence non-violent offenders to die behind bars.” Life without parole for non-violent sentences has been ruled a violation of human rights by the European Court of Human Rights. The UK is one of only two countries in Europe that still metes out the penalty at all, and even then only in 49 cases of murder."

Saturday, November 16, 2013

For JPMorgan, $4.5 Billion to Settle Mortgage Claims - NYTimes.com

For JPMorgan, $4.5 Billion to Settle Mortgage Claims - NYTimes.com

"The checks from JPMorgan Chase just keep on coming as the nation’s largest bank works to move beyond its mortgage-related troubles.

On Friday, JPMorgan reached a $4.5 billion settlement with a group of investors over claims that the bank sold them shaky mortgage-backed securities that imploded later, leading to large losses.

The multibillion-dollar payout is separate from the tentative $13 billion settlement that JPMorgan reached with the Justice Department over the bank’s questionable mortgage practices in the run-up to the financial crisis. That deal could be announced as early as next week, according to people briefed on the settlement."

"The checks from JPMorgan Chase just keep on coming as the nation’s largest bank works to move beyond its mortgage-related troubles.

On Friday, JPMorgan reached a $4.5 billion settlement with a group of investors over claims that the bank sold them shaky mortgage-backed securities that imploded later, leading to large losses.

The multibillion-dollar payout is separate from the tentative $13 billion settlement that JPMorgan reached with the Justice Department over the bank’s questionable mortgage practices in the run-up to the financial crisis. That deal could be announced as early as next week, according to people briefed on the settlement."

Sales at Wal-Mart, Macy’s hint at two consumer realities - The Washington Post

Sales at Wal-Mart, Macy’s hint at two consumer realities - The Washington Post

"When assessing how Americans are feeling about their economic well-being, there are a couple of powerful indicators to consider: Macy’s and Wal-Mart.

Although lots of other companies represent pieces of the economic picture, those two retailers sell a broad variety of household goods for nearly the full spectrum of consumers. Upper-income folks are more likely to shop at Macy’s — which also owns the tonier Bloomingdale’s — while lower-income shoppers often depend on Wal-Mart.

Right now, the two companies are telling us something that’s been apparent for a while but is growing clearer month by month: The wealthy in America seem to be doing all right, but everybody else remains very cautious."

"When assessing how Americans are feeling about their economic well-being, there are a couple of powerful indicators to consider: Macy’s and Wal-Mart.

Although lots of other companies represent pieces of the economic picture, those two retailers sell a broad variety of household goods for nearly the full spectrum of consumers. Upper-income folks are more likely to shop at Macy’s — which also owns the tonier Bloomingdale’s — while lower-income shoppers often depend on Wal-Mart.

Right now, the two companies are telling us something that’s been apparent for a while but is growing clearer month by month: The wealthy in America seem to be doing all right, but everybody else remains very cautious."

Thursday, November 14, 2013

Contra Costa has suffered steepest home-price drop among large U.S. counties - Capitol Report - MarketWatch

Contra Costa has suffered steepest home-price drop among large U.S. counties - MarketWatch

Among the most populous U.S. counties, Contra Costa County in Northern California saw the largest drop in home values in recent years, according to government data released Thursday.

Contra Costa County’s median property value during the 2010-to-2012 period was about $392,900, down $141,500, 0r 26%, from a median of $534,400 over the 2007-to-2009 period, according to U.S. Census Bureau data. Those results compare with a U.S. drop of about $17,300, or 9%, to $174,600 over the same time period.

Among the country’s 50 counties with the largest populations, eight of the top 10 price drops were in California counties. California, of course, is the most populous U.S. state and home to numerous communities that were hit particularly hard when the housing bubble burst. The two non-California counties in the top 10 were Miami–Dade County in Florida and Nevada’s Clark County, of which Las Vegas is the county seat.

Among the most populous U.S. counties, Contra Costa County in Northern California saw the largest drop in home values in recent years, according to government data released Thursday.

Contra Costa County’s median property value during the 2010-to-2012 period was about $392,900, down $141,500, 0r 26%, from a median of $534,400 over the 2007-to-2009 period, according to U.S. Census Bureau data. Those results compare with a U.S. drop of about $17,300, or 9%, to $174,600 over the same time period.

Among the country’s 50 counties with the largest populations, eight of the top 10 price drops were in California counties. California, of course, is the most populous U.S. state and home to numerous communities that were hit particularly hard when the housing bubble burst. The two non-California counties in the top 10 were Miami–Dade County in Florida and Nevada’s Clark County, of which Las Vegas is the county seat.

Tuesday, November 12, 2013

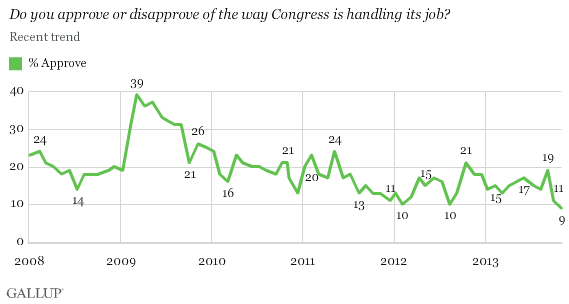

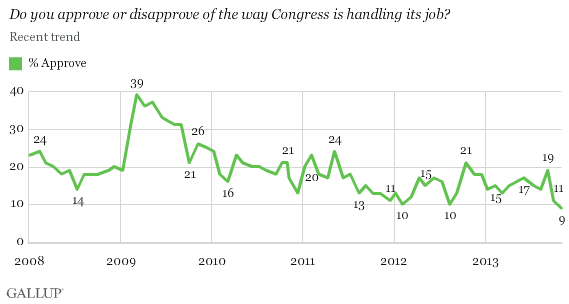

Congressional Approval Sinks to Record Low

Congressional Approval Sinks to Record Low

" Americans' approval of the way Congress is handling its job has dropped to 9%, the lowest in Gallup's 39-year history of asking the question. The previous low point was 10%, registered twice in 2012."

Billionaire Wealth Doubles: Wealth of Billionaires Doubles Since Financial Crisis

Billionaire Wealth Doubles: Wealth of Billionaires Doubles Since Financial Crisis

"Billionaire wealth has doubled in the past four years since the financial crisis, says a report from Wealth-X. The combined wealth of billionaires has doubled from $3.1 trillion to $6.5 trillion.

The total wealth of the world’s billionaires is larger than any country on Earth except the United States and China, reported CNBC."

"Billionaire wealth has doubled in the past four years since the financial crisis, says a report from Wealth-X. The combined wealth of billionaires has doubled from $3.1 trillion to $6.5 trillion.

The total wealth of the world’s billionaires is larger than any country on Earth except the United States and China, reported CNBC."

Monday, November 11, 2013

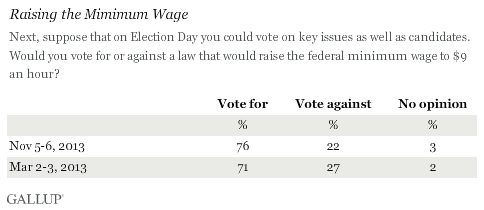

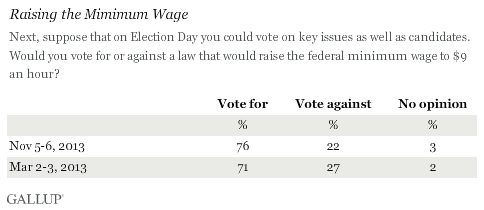

Most Americans for Raising Minimum Wage

Gallup: Most Americans for Raising Minimum Wage

"With momentum building at the federal and state level to increase hourly base pay, more than three-quarters of Americans (76%) say they would vote for raising the minimum wage to $9 per hour (it is currently $7.25) in a hypothetical national referendum, a five-percentage-point increase since March. About one-fifth (22%) would vote against this."

"With momentum building at the federal and state level to increase hourly base pay, more than three-quarters of Americans (76%) say they would vote for raising the minimum wage to $9 per hour (it is currently $7.25) in a hypothetical national referendum, a five-percentage-point increase since March. About one-fifth (22%) would vote against this."

Feds seek $864M from BofA over Countrywide loans

Feds seek $864M from BofA over Countrywide loans

"Federal prosecutors want Bank of America to pay about $864 million over losses incurred by the government after it bought thousands of home loans made by Countrywide Financial during the housing boom.

U.S. Attorney Preet Bharara made the request in documents filed late Friday with the U.S. District Court in Manhattan.

A jury in October found Bank of America, which acquired Countrywide in 2008, liable for knowingly selling thousands of bad home loans to Fannie Mae and Freddie Mac between August 2007 and May 2008."

"Federal prosecutors want Bank of America to pay about $864 million over losses incurred by the government after it bought thousands of home loans made by Countrywide Financial during the housing boom.

U.S. Attorney Preet Bharara made the request in documents filed late Friday with the U.S. District Court in Manhattan.

A jury in October found Bank of America, which acquired Countrywide in 2008, liable for knowingly selling thousands of bad home loans to Fannie Mae and Freddie Mac between August 2007 and May 2008."

Monday, November 04, 2013

SAC Capital Agrees to Plead Guilty to Insider Trading - NYTimes.com

SAC Capital Agrees to Plead Guilty to Insider Trading - NYTimes.com

"... federal prosecutors announced that Mr. Cohen’s firm, SAC Capital Advisors, had agreed to plead guilty to insider trading violations and pay a record $1.2 billion penalty, becoming the first large Wall Street firm in a generation to confess to criminal conduct. The government has also forced SAC to terminate its business of managing money for outside investors.

Insider trading at SAC was “substantial, pervasive and on a scale without precedent in the history of hedge funds,” said Preet Bharara, the United States attorney in Manhattan. His office has criminally charged eight former SAC employees; six have pleaded guilty."

"... federal prosecutors announced that Mr. Cohen’s firm, SAC Capital Advisors, had agreed to plead guilty to insider trading violations and pay a record $1.2 billion penalty, becoming the first large Wall Street firm in a generation to confess to criminal conduct. The government has also forced SAC to terminate its business of managing money for outside investors.

Insider trading at SAC was “substantial, pervasive and on a scale without precedent in the history of hedge funds,” said Preet Bharara, the United States attorney in Manhattan. His office has criminally charged eight former SAC employees; six have pleaded guilty."

Johnson & Johnson to pay $2.2 billion in Risperdal settlement - The Economic Times

Johnson & Johnson to pay $2.2 billion in Risperdal settlement - The Economic Times

"Johnson & Johnson has agreed to pay more than $2.2 billion in criminal and civil fines to settle accusations that it improperly promoted the antipsychotic drug Risperdal to older adults, children and people with developmental disabilities, the Justice Department said on Monday.

The agreement is the third-largest pharmaceutical settlement in U.S. history and the largest in a string of recent cases involving the marketing of antipsychotic and anti-seizure drugs to older dementia patients. It is part of a decade-long effort by the federal government to hold the health care giant - and other pharmaceutical companies - accountable for illegally marketing the drugs as a way to control patients with dementia in nursing homes and children with certain behavioral disabilities, despite the health risks of the drugs. "

"Johnson & Johnson has agreed to pay more than $2.2 billion in criminal and civil fines to settle accusations that it improperly promoted the antipsychotic drug Risperdal to older adults, children and people with developmental disabilities, the Justice Department said on Monday.

The agreement is the third-largest pharmaceutical settlement in U.S. history and the largest in a string of recent cases involving the marketing of antipsychotic and anti-seizure drugs to older dementia patients. It is part of a decade-long effort by the federal government to hold the health care giant - and other pharmaceutical companies - accountable for illegally marketing the drugs as a way to control patients with dementia in nursing homes and children with certain behavioral disabilities, despite the health risks of the drugs. "

Saturday, October 26, 2013

The Great Voucher Fraud | Alternet

The Great Voucher Fraud | Alternet

"Despite the best efforts of “school choice” advocates to spin the effectiveness of vouchers, decades of accumulated evidence paints a different story: Vouchers do not improve educational outcomes, they take money away from struggling public schools, they’re cash cows for institutions offering questionable education, they aid students already attending private institutions and they ignore the needs of special-education students."

"Voucher advocates have become adept at employing several lobbying arms, all of which have the ability to curry favor with certain types of legislators.

Powerful groups like the American Legislative Exchange Council, the Heritage Foundation, Betsy DeVos’ American Federation of Children and other far-right groups that hate public services provide a rich funding stream for the voucher movement.

Organizations like these talk about helping children. But their real goal is to crush teachers’ unions and shift education from the public to the private sector, opening up potentially billions for rapacious for-profit firms that would love nothing better than to “Walmart-ize” American education.

Joining them are fundamentalist Christians, who believe public education is “godless.” They seek tax support for their network of private independent schools, many of which teach Bible stories in place of science, offer discredited “Christian nation” views of history and are stridently anti-gay and anti-woman.

The Catholic bishops provide the final piece of the puzzle. Catholic schools have been in steep decline for decades, as more and more parents realize their children can get a good education in local public schools (schools that are free of the ultra-conservative dogma that saturates many Catholic institutions). Unable to control their unruly U.S. flock, the bishops are essentially seeking a taxpayer-funded bailout of a private school system that fewer and fewer Catholic parents see as necessary."

"

Consider Wisconsin’s private school voucher program, which at 23 years and counting makes it the oldest of its kind in the United States. In 2011, a study found that students participating in the Milwaukee Parental Choice Program scored proficient or advanced on standardized tests at a rate of 34.4 percent in math and 55.2 percent for reading, but students in Milwaukee Public Schools scored proficient or advanced at a rate of 47.8 percent in math and 59 percent in reading on the same assessments, according to the Wisconsin Department of Public Instruction.

The results have been equally unspectacular elsewhere. An analysis of Louisiana’s voucher program, released in May, found about 40 percent of third through eighth graders receiving vouchers scored at or above their grade level on statewide tests in English, math, social studies and science; by comparison, 69 percent of all third through eighth grade students statewide scored at or above grade level on those tests.

Likewise, a 2003 study of Cleveland’s then eight-year-old voucher scheme showed the program failed to boost the academic performance of the students taking part in it. The analysis, conducted by independent researcher Kim Metcalf of Indiana University, found that students participating in the program are doing no better academically than their public school counterparts."

"

Alan B. Krueger, a professor of economics and public policy, analyzed data presented in 2002 by Harvard University Professor of Government Paul E. Peterson, a voucher advocate, that found black students in the voucher schools scored 5.5 points higher on standardized tests than their counterparts in public schools.

Krueger’s own study of the data, however, showed no academic gains for African-American students in the voucher plan, reported Education Week. In analyzing the data, Krueger concluded that Peterson had erred by omitting too many children from the statistical sample. He also found that allowing a parent or guardian to state a child’s race led to children of mixed race being omitted from the sample when they should have been included. Including the omitted children, Krueger found a gain of only 1.44 percentile points on standardized tests, a figure that is not statistically significant."

"Despite the best efforts of “school choice” advocates to spin the effectiveness of vouchers, decades of accumulated evidence paints a different story: Vouchers do not improve educational outcomes, they take money away from struggling public schools, they’re cash cows for institutions offering questionable education, they aid students already attending private institutions and they ignore the needs of special-education students."

"Voucher advocates have become adept at employing several lobbying arms, all of which have the ability to curry favor with certain types of legislators.

Powerful groups like the American Legislative Exchange Council, the Heritage Foundation, Betsy DeVos’ American Federation of Children and other far-right groups that hate public services provide a rich funding stream for the voucher movement.

Organizations like these talk about helping children. But their real goal is to crush teachers’ unions and shift education from the public to the private sector, opening up potentially billions for rapacious for-profit firms that would love nothing better than to “Walmart-ize” American education.

Joining them are fundamentalist Christians, who believe public education is “godless.” They seek tax support for their network of private independent schools, many of which teach Bible stories in place of science, offer discredited “Christian nation” views of history and are stridently anti-gay and anti-woman.

The Catholic bishops provide the final piece of the puzzle. Catholic schools have been in steep decline for decades, as more and more parents realize their children can get a good education in local public schools (schools that are free of the ultra-conservative dogma that saturates many Catholic institutions). Unable to control their unruly U.S. flock, the bishops are essentially seeking a taxpayer-funded bailout of a private school system that fewer and fewer Catholic parents see as necessary."

"

Consider Wisconsin’s private school voucher program, which at 23 years and counting makes it the oldest of its kind in the United States. In 2011, a study found that students participating in the Milwaukee Parental Choice Program scored proficient or advanced on standardized tests at a rate of 34.4 percent in math and 55.2 percent for reading, but students in Milwaukee Public Schools scored proficient or advanced at a rate of 47.8 percent in math and 59 percent in reading on the same assessments, according to the Wisconsin Department of Public Instruction.

The results have been equally unspectacular elsewhere. An analysis of Louisiana’s voucher program, released in May, found about 40 percent of third through eighth graders receiving vouchers scored at or above their grade level on statewide tests in English, math, social studies and science; by comparison, 69 percent of all third through eighth grade students statewide scored at or above grade level on those tests.

Likewise, a 2003 study of Cleveland’s then eight-year-old voucher scheme showed the program failed to boost the academic performance of the students taking part in it. The analysis, conducted by independent researcher Kim Metcalf of Indiana University, found that students participating in the program are doing no better academically than their public school counterparts."

"

Alan B. Krueger, a professor of economics and public policy, analyzed data presented in 2002 by Harvard University Professor of Government Paul E. Peterson, a voucher advocate, that found black students in the voucher schools scored 5.5 points higher on standardized tests than their counterparts in public schools.

Krueger’s own study of the data, however, showed no academic gains for African-American students in the voucher plan, reported Education Week. In analyzing the data, Krueger concluded that Peterson had erred by omitting too many children from the statistical sample. He also found that allowing a parent or guardian to state a child’s race led to children of mixed race being omitted from the sample when they should have been included. Including the omitted children, Krueger found a gain of only 1.44 percentile points on standardized tests, a figure that is not statistically significant."

The Irony and Limits of the Affordable Care Act | Dissent Magazine

The Irony and Limits of the Affordable Care Act | Dissent Magazine

"A larger irony is that the ACA is about as far from a government takeover of health care or the “final leap to socialism” (as Michele Bachmann sees it) as one can imagine. Such hyperbole is now about a century old. In 1917 insurance executives raised the fear of “Prussian” or “Bolshevik” medicine. In the 1940s the American Medical Association fabricated a quote from Lenin—“socialized medicine is the keystone in the arch of the socialist state”—to punctuate its Cold War campaign against public health insurance. During the early debate over Medicare in 1961, Ronald Reagan warned that “you and I may well spend our sunset years telling our children and our children’s children what it once was like in America when men were free.” These scare tactics usually worked. The power of southern segregationists in Congress doomed much of the New Deal’s timid universalism. Deference to the AMA virtually immobilized health reform in the 1940s and 1950s. Job-based coverage emerged as the next-best bet, while public policy retreated to occasional efforts to mitigate its failures—most notably with the passage of Medicare and Medicaid in 1965. Since then efforts to appease health care industry interests and avoid the “socialized medicine” label have routinely turned good intentions into bad policy or legislative shipwrecks. Republican pollster Frank Luntz’s now-infamous 2009 memo “The Language of Healthcare” set out the basic talking points that would later pepper Ted Cruz’s filibuster: any public program or option is a slippery slope to “government takeover” and national health systems (insert Canadian or British horror story here) that stifle innovation, encourage malingering, and ration care—either by forcing patients to wait or by pulling the plug."

"In terms of coverage, efficiency, and equity, the ACA is a far cry from a single-payer system. Some hope that it might push us along that path (either through its sheer failure or by incremental tinkering with its provisions), and some fear that it might block the way (by marginalizing the remaining uninsured or simply poisoning the well for future reformers). In either case, the ACA is better than nothing and it has already had a real impact. Health care costs are falling. While slower spending is largely attributable to a slow recovery from a long recession, it also reflects the rollout of some of the ACA’s cost-containment provisions and the response of private insurers to the threat (and now the reality) of modest health reform. And the uninsured are finding coverage. Thanks to the ACA’s requirement that insurers allow children to stay on their parents’ plan until they are twenty-six, the uninsured rate among young adults has fallen for two consecutive years. None of the economic calamity predicted (or pined for) by congressional Republicans has come to pass. The law actually imposes little obligation, cost, or uncertainty on employers. Ninety four percent of firms affected by the ACA’s employer mandate already provide coverage voluntarily. There is no empirical evidence that the ACA is a “job killer” or that employers are gaming the mandate (now pushed off to 2014 anyway) by ducking under the fifty-worker threshold or cutting workers back to part-time status. The promise for the future is substantial. The combination of insurance regulations and state exchanges provides coverage options for millions of uninsured Americans. Most of those finding insurance via the ACA will qualify for subsidies that reduce the costs of that coverage. And the ACA will enhance the health security of those who are already covered by checking the capriciousness of private insurers and providing a softer landing for those who lose a job or job-based coverage."

"But let’s not get ahead of ourselves. In the rush to defend the ACA (and the larger ideal of a robust public sector) against the GOP’s suicide caucus, we are smearing a lot of lipstick on a pretty ugly pig. This is a timid law that will likely show timid results in the long run. Real health reform–like that proposed in 1948, 1965, 1972, and 1992—demands that we confront three problems studiously avoided (and in some respects made worse) by the ACA."

"At the root of our ongoing health crisis (both the unconscionable rate of uninsurance and a level of spending nearly double the OECD average) is our reliance on jobs as a means of distributing and paying for health coverage. This is an historical accident, which began as an ad hoc arrangement to evade Second World War-era wage and tax regulations by offering employees non-monetary compensation."

"The ACA’s second major flaw is its deference to the states on key aspects of eligibility and access....Despite the fact that the expansion will be paid for largely with federal dollars (full federal funding through 2016, no less than 90 percent after that), fully half of the states have passed on meaningful participation (twenty have turned the idea down flat and five more are undecided). Not surprisingly, the states that have thumbed their nose at the ACA are among the nation’s poorest and—with a midwestern inroad–closely follow the contours of the old Jim Crow South. According to a recent analysis by the New York Times, state-level recalcitrance will leave two-thirds of poor blacks, two-thirds of single mothers, and half of all uninsured low-wage workers ineligible for Medicaid and therefore unable to afford coverage offered by the insurance exchanges. This regional unevenness blunts the ACA’s impact by limiting its reach where is most needed. It leaves the fate of a federal law in the hands of fickle and deeply partisan state legislatures."

..."the ACA’s third major flaw: its inability or unwillingness to displace private insurance. In this respect, one baseline assumption of health reform has remained unchanged since the 1930s: we already pay for national health insurance, we just don’t get any of the benefits. As a consequence of incremental timidity, we spend as many public dollars on health care as any of our democratic and industrialized peers. We then spend as much again in private dollars–for a per capita bill more than double the OECD average—and claim precious little (widespread insecurity, lousy health outcomes, and high costs) in return."

" ...any reform that simply lards new coverage options onto the old system of private insurance will be hard pressed to realize any real efficiencies or savings in the long haul. Propping up the current health care system—or pushing more people into it via individual or employer mandates—does nothing to address the administrative waste, actuarial complexity, or naked profiteering that created our health care crisis in the first place."

"A larger irony is that the ACA is about as far from a government takeover of health care or the “final leap to socialism” (as Michele Bachmann sees it) as one can imagine. Such hyperbole is now about a century old. In 1917 insurance executives raised the fear of “Prussian” or “Bolshevik” medicine. In the 1940s the American Medical Association fabricated a quote from Lenin—“socialized medicine is the keystone in the arch of the socialist state”—to punctuate its Cold War campaign against public health insurance. During the early debate over Medicare in 1961, Ronald Reagan warned that “you and I may well spend our sunset years telling our children and our children’s children what it once was like in America when men were free.” These scare tactics usually worked. The power of southern segregationists in Congress doomed much of the New Deal’s timid universalism. Deference to the AMA virtually immobilized health reform in the 1940s and 1950s. Job-based coverage emerged as the next-best bet, while public policy retreated to occasional efforts to mitigate its failures—most notably with the passage of Medicare and Medicaid in 1965. Since then efforts to appease health care industry interests and avoid the “socialized medicine” label have routinely turned good intentions into bad policy or legislative shipwrecks. Republican pollster Frank Luntz’s now-infamous 2009 memo “The Language of Healthcare” set out the basic talking points that would later pepper Ted Cruz’s filibuster: any public program or option is a slippery slope to “government takeover” and national health systems (insert Canadian or British horror story here) that stifle innovation, encourage malingering, and ration care—either by forcing patients to wait or by pulling the plug."

"In terms of coverage, efficiency, and equity, the ACA is a far cry from a single-payer system. Some hope that it might push us along that path (either through its sheer failure or by incremental tinkering with its provisions), and some fear that it might block the way (by marginalizing the remaining uninsured or simply poisoning the well for future reformers). In either case, the ACA is better than nothing and it has already had a real impact. Health care costs are falling. While slower spending is largely attributable to a slow recovery from a long recession, it also reflects the rollout of some of the ACA’s cost-containment provisions and the response of private insurers to the threat (and now the reality) of modest health reform. And the uninsured are finding coverage. Thanks to the ACA’s requirement that insurers allow children to stay on their parents’ plan until they are twenty-six, the uninsured rate among young adults has fallen for two consecutive years. None of the economic calamity predicted (or pined for) by congressional Republicans has come to pass. The law actually imposes little obligation, cost, or uncertainty on employers. Ninety four percent of firms affected by the ACA’s employer mandate already provide coverage voluntarily. There is no empirical evidence that the ACA is a “job killer” or that employers are gaming the mandate (now pushed off to 2014 anyway) by ducking under the fifty-worker threshold or cutting workers back to part-time status. The promise for the future is substantial. The combination of insurance regulations and state exchanges provides coverage options for millions of uninsured Americans. Most of those finding insurance via the ACA will qualify for subsidies that reduce the costs of that coverage. And the ACA will enhance the health security of those who are already covered by checking the capriciousness of private insurers and providing a softer landing for those who lose a job or job-based coverage."

"At the root of our ongoing health crisis (both the unconscionable rate of uninsurance and a level of spending nearly double the OECD average) is our reliance on jobs as a means of distributing and paying for health coverage. This is an historical accident, which began as an ad hoc arrangement to evade Second World War-era wage and tax regulations by offering employees non-monetary compensation."

"The ACA’s second major flaw is its deference to the states on key aspects of eligibility and access....Despite the fact that the expansion will be paid for largely with federal dollars (full federal funding through 2016, no less than 90 percent after that), fully half of the states have passed on meaningful participation (twenty have turned the idea down flat and five more are undecided). Not surprisingly, the states that have thumbed their nose at the ACA are among the nation’s poorest and—with a midwestern inroad–closely follow the contours of the old Jim Crow South. According to a recent analysis by the New York Times, state-level recalcitrance will leave two-thirds of poor blacks, two-thirds of single mothers, and half of all uninsured low-wage workers ineligible for Medicaid and therefore unable to afford coverage offered by the insurance exchanges. This regional unevenness blunts the ACA’s impact by limiting its reach where is most needed. It leaves the fate of a federal law in the hands of fickle and deeply partisan state legislatures."

..."the ACA’s third major flaw: its inability or unwillingness to displace private insurance. In this respect, one baseline assumption of health reform has remained unchanged since the 1930s: we already pay for national health insurance, we just don’t get any of the benefits. As a consequence of incremental timidity, we spend as many public dollars on health care as any of our democratic and industrialized peers. We then spend as much again in private dollars–for a per capita bill more than double the OECD average—and claim precious little (widespread insecurity, lousy health outcomes, and high costs) in return."

" ...any reform that simply lards new coverage options onto the old system of private insurance will be hard pressed to realize any real efficiencies or savings in the long haul. Propping up the current health care system—or pushing more people into it via individual or employer mandates—does nothing to address the administrative waste, actuarial complexity, or naked profiteering that created our health care crisis in the first place."

Facebook Feminism, Like It or Not | Susan Faludi | The Baffler

Facebook Feminism, Like It or Not | Susan Faludi | The Baffler

"Since its unveiling this spring, the Lean In campaign has been reeling in a steadily expanding group of tens of thousands of followers with its tripartite E-Z plan for getting to the top. But the real foundation of the movement is, of course, Sheryl Sandberg’s bestselling book, Lean In: Women, Work, and the Will to Lead, billed modestly by its author as “sort of a feminist manifesto.” Sandberg’s mantra has become the feminist rallying cry of the moment, praised by notable figures such as Gloria Steinem, Jane Fonda, Marlo Thomas, and Nation columnist Katha Pollitt. A Time magazine cover story hails Sandberg for “embarking on the most ambitious mission to reboot feminism and reframe discussions of gender since the launch of Ms. magazine in 1971.” Pretty good for somebody who, “as of two and a half years ago,” as Sandberg confessed on her book tour, “had never said the word woman aloud. Because that’s not how you get ahead in the world.”

"Beneath highly manicured glam shots, each “member” or “partner” reveals her personal “Lean In moment.” The accounts inevitably have happy finales—the Lean In guidelines instruct contributors to “share a positive ending.” Tina Brown’s Lean In moment: getting her parents to move from England to “the apartment across the corridor from us on East 57th Street in New York,” so her mother could take care of the children while Brown took the helm at The New Yorker. If you were waiting for someone to lean in for child care legislation, keep holding your breath. So far, there’s no discernible groundswell."

"But there seems to be little tangible cross-class solidarity coming from the triumphalists, despite their claims to be speaking for all womankind. “If we can succeed in adding more female voices at the highest levels,” Sandberg writes in her book, “we will expand opportunities and extend fairer treatment to all.” But which highest-level voices? When former British prime minister Margaret (“I hate feminism”) Thatcher died, Lean In’s Facebook page paid homage to the Iron Lady and invited its followers to post “which moments were most memorable to you” from Thatcher’s tenure. That invitation inspired a rare outburst of un-“positive” remarks in the comment section, at least from some women in the U.K. “Really??” wrote one. “She was a tyrant. . . . Just because a woman is in a leadership position does not make her worthy of respect, especially if you were on the receiving end of what she did to lots of people.” “So disappointing that Lean In endorses Thatcher as a positive female role model,” wrote another. “She made history as a woman, but went on to use her power to work against the most vulnerable, including women and their children.”

"In the 1920s, male capitalists invoked feminism to advance their brands of corporate products. Nearly a century later, female marketers are invoking capitalism to advance their corporate brand of feminism. Sandberg’s “Lean In Community” is Exhibit A. What is she selling, after all, if not the product of the company she works for? Every time a woman signs up for Lean In, she’s made another conquest for Facebook. Facebook conquers women in more than one way. Nearly 60 percent of the people who do the daily labor on Facebook—maintaining their pages, posting their images, tagging their friends, driving the traffic—are female, and, unlike the old days of industrial textile manufacturing, they don’t even have to be paid or housed. “Facebook benefits every time a woman uploads her picture,” Kate Losse, a former employee of Facebook and author of The Boy Kings, a keenly observed memoir of her time there, pointed out to me. “And what is she getting? Nothing, except a constant flow of ‘likes.’”

"When asked about women’s representation at the company during media appearances for her book tour, Sandberg was vague. “We’re ahead of the industry,” she told one interviewer, noting that a woman heads Facebook’s “global sales” and another is “running design,” before briskly changing the subject."

"Since its unveiling this spring, the Lean In campaign has been reeling in a steadily expanding group of tens of thousands of followers with its tripartite E-Z plan for getting to the top. But the real foundation of the movement is, of course, Sheryl Sandberg’s bestselling book, Lean In: Women, Work, and the Will to Lead, billed modestly by its author as “sort of a feminist manifesto.” Sandberg’s mantra has become the feminist rallying cry of the moment, praised by notable figures such as Gloria Steinem, Jane Fonda, Marlo Thomas, and Nation columnist Katha Pollitt. A Time magazine cover story hails Sandberg for “embarking on the most ambitious mission to reboot feminism and reframe discussions of gender since the launch of Ms. magazine in 1971.” Pretty good for somebody who, “as of two and a half years ago,” as Sandberg confessed on her book tour, “had never said the word woman aloud. Because that’s not how you get ahead in the world.”

"Beneath highly manicured glam shots, each “member” or “partner” reveals her personal “Lean In moment.” The accounts inevitably have happy finales—the Lean In guidelines instruct contributors to “share a positive ending.” Tina Brown’s Lean In moment: getting her parents to move from England to “the apartment across the corridor from us on East 57th Street in New York,” so her mother could take care of the children while Brown took the helm at The New Yorker. If you were waiting for someone to lean in for child care legislation, keep holding your breath. So far, there’s no discernible groundswell."

"But there seems to be little tangible cross-class solidarity coming from the triumphalists, despite their claims to be speaking for all womankind. “If we can succeed in adding more female voices at the highest levels,” Sandberg writes in her book, “we will expand opportunities and extend fairer treatment to all.” But which highest-level voices? When former British prime minister Margaret (“I hate feminism”) Thatcher died, Lean In’s Facebook page paid homage to the Iron Lady and invited its followers to post “which moments were most memorable to you” from Thatcher’s tenure. That invitation inspired a rare outburst of un-“positive” remarks in the comment section, at least from some women in the U.K. “Really??” wrote one. “She was a tyrant. . . . Just because a woman is in a leadership position does not make her worthy of respect, especially if you were on the receiving end of what she did to lots of people.” “So disappointing that Lean In endorses Thatcher as a positive female role model,” wrote another. “She made history as a woman, but went on to use her power to work against the most vulnerable, including women and their children.”

"In the 1920s, male capitalists invoked feminism to advance their brands of corporate products. Nearly a century later, female marketers are invoking capitalism to advance their corporate brand of feminism. Sandberg’s “Lean In Community” is Exhibit A. What is she selling, after all, if not the product of the company she works for? Every time a woman signs up for Lean In, she’s made another conquest for Facebook. Facebook conquers women in more than one way. Nearly 60 percent of the people who do the daily labor on Facebook—maintaining their pages, posting their images, tagging their friends, driving the traffic—are female, and, unlike the old days of industrial textile manufacturing, they don’t even have to be paid or housed. “Facebook benefits every time a woman uploads her picture,” Kate Losse, a former employee of Facebook and author of The Boy Kings, a keenly observed memoir of her time there, pointed out to me. “And what is she getting? Nothing, except a constant flow of ‘likes.’”

Losse quit in 2010 to become a writer—of her own words, not her boss’s. Earlier this year, she wrote a thought-provoking piece about Lean In for Dissent, “Feminism’s Tipping Point: Who Wins from Leaning In?” The winners, she noted, are not the women in tech, who “are much more likely to be hired in support functions where they are paid a bare minimum, given tiny equity grants compared to engineers and executives, and given raises on the order of fifty cents an hour rather than thousands of dollars.” These are the fast-growth jobs for women in high technology, just as Menlo Park’s postindustrial campuses are the modern equivalent of the Lowell company town. Sandberg’s book proposed to remedy that system, Losse noted, not by changing it but simply by telling women to work harder:

Life is a race, Sandberg is telling us, and the way to win is through the perpetual acceleration of one’s own labor: moving forward, faster. The real antagonist identified by Lean In then is not institutionalized discrimination against women, but women’s reluctance to accept accelerating career demands.For her candor, Losse came under instant attack from the Sandberg sisterhood. Brandee Barker, a Lean In publicist and former head of public relations for Facebook, sent Losse the following message: “There’s a special place in hell for you.”

"When asked about women’s representation at the company during media appearances for her book tour, Sandberg was vague. “We’re ahead of the industry,” she told one interviewer, noting that a woman heads Facebook’s “global sales” and another is “running design,” before briskly changing the subject."

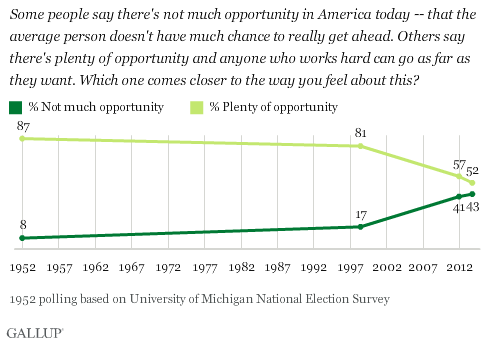

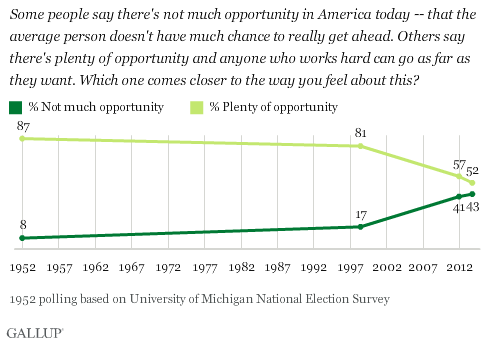

In U.S., Fewer Believe "Plenty of Opportunity" to Get Ahead

In U.S., Fewer Believe "Plenty of Opportunity" to Get Ahead

" Fewer Americans believe there is "plenty of opportunity" to get ahead in America today than have said so across three previous measurement points over the last 59 years. A bare majority (52%) say the country has plenty of economic opportunity, down from 57% in 2011 and more substantially from 81% in 1998."

" Fewer Americans believe there is "plenty of opportunity" to get ahead in America today than have said so across three previous measurement points over the last 59 years. A bare majority (52%) say the country has plenty of economic opportunity, down from 57% in 2011 and more substantially from 81% in 1998."

Thursday, October 24, 2013

'The Daily Show' and the Wall Street 'Witch Hunt' - NYTimes.com

'The Daily Show' and the Wall Street 'Witch Hunt' - NYTimes.com

I was wondering why nobody was taking on the sycophancy of the CNBC "financial journalists" to JPMorgan Chase CEO Jamie Dimon.

Until now.

Must watch!

Watch Jon Stewart tear down the argument that the Jamie Dimon was forced to buy Bear Sterns and Washington Mutual:

I was wondering why nobody was taking on the sycophancy of the CNBC "financial journalists" to JPMorgan Chase CEO Jamie Dimon.

Until now.

Must watch!

Watch Jon Stewart tear down the argument that the Jamie Dimon was forced to buy Bear Sterns and Washington Mutual:

Wednesday, October 23, 2013

The media can't stop sucking up to Alan Greenspan | New Republic

The media can't stop sucking up to Alan Greenspan | New Republic

"...anyone who’s paid attention to the economy the past few years knows how ridiculous it is to fete Greenspan, the main architect of the policies that led to the Great Recession. If we lived in a just world, we would put him on trial, not on television. And his penalty should be to scrounge up the funds to pay JPMorgan Chase’s $13 billion fine with the Justice Department."

"After all, that fine penalizes JPMorgan Chase for duping investors into purchasing mortgage-backed securities it knew were stuffed with garbage loans. And nobody in America duped more people—investors, homeowners, you name it—into buying bad loans than Alan Greenspan. While chairing the Fed, Greenspan was in a perfect position to inform Americans about the unsustainability of the housing bubble and the overall threats to the financial system. But his allergy to regulation and unshakeable belief in the virtues of the free market led him to ignore the bubble and its risks, infusing investors and consumers with confidence that the run-up in home prices was perfectly normal. If misleading the public about the safety and soundness of the housing market is a crime, Greenspan is guilty. And he deserves some manner of punishment for that, not a week full of deference and respect."

"...Greenspan willfully ignored the forces operating under his nose. He knew that brokers were selling not only ARMs, but no-documentation “liar’s loans” and other dodgy products to unsuspecting subprime borrowers. Fed Governor Edward Gramlich gave a speech on the challenges of subprime just three months after Greenspan encouraged everyone to go into adjustable-rate loans. By September of that year, the FBI warned of a mortgage fraud “epidemic,” particularly from this new breed of suspect mortgage brokers. Advisors warned him on multiple occasions to do something about the growing problem, to guard against overall risk and protect consumers from harm.

"...anyone who’s paid attention to the economy the past few years knows how ridiculous it is to fete Greenspan, the main architect of the policies that led to the Great Recession. If we lived in a just world, we would put him on trial, not on television. And his penalty should be to scrounge up the funds to pay JPMorgan Chase’s $13 billion fine with the Justice Department."

"After all, that fine penalizes JPMorgan Chase for duping investors into purchasing mortgage-backed securities it knew were stuffed with garbage loans. And nobody in America duped more people—investors, homeowners, you name it—into buying bad loans than Alan Greenspan. While chairing the Fed, Greenspan was in a perfect position to inform Americans about the unsustainability of the housing bubble and the overall threats to the financial system. But his allergy to regulation and unshakeable belief in the virtues of the free market led him to ignore the bubble and its risks, infusing investors and consumers with confidence that the run-up in home prices was perfectly normal. If misleading the public about the safety and soundness of the housing market is a crime, Greenspan is guilty. And he deserves some manner of punishment for that, not a week full of deference and respect."

"...Greenspan willfully ignored the forces operating under his nose. He knew that brokers were selling not only ARMs, but no-documentation “liar’s loans” and other dodgy products to unsuspecting subprime borrowers. Fed Governor Edward Gramlich gave a speech on the challenges of subprime just three months after Greenspan encouraged everyone to go into adjustable-rate loans. By September of that year, the FBI warned of a mortgage fraud “epidemic,” particularly from this new breed of suspect mortgage brokers. Advisors warned him on multiple occasions to do something about the growing problem, to guard against overall risk and protect consumers from harm.

But instead of tamping down the irrational exuberance in the housing markets, Greenspan encouraged homeowners to seek out precisely the types of products being fraudulently peddled by unscrupulous brokers. This fed the securitization machine and inflated the bubble. At the time, the Federal Reserve had consumer protection responsibilities for mortgages, but Greenspan did absolutely nothing to stop the rotten lending that would eventually implode the housing market. In addition, Greenspan lauded securitization in testimony before the Senate Banking Committee in 2005, saying it “does not create substantial systemic risks.” Only after he left the Fed, in 2008, did Greenspan decide that securitization was the culprit for the crisis. Greenspan pursued no regulatory avenues to deflate the bubble, nor did he bother to speak publicly about the dangers. Like a good Ayn Rand acolyte, Greenspan simply believed that lending institutions would act in their self-interest and never engage in destructive behavior. “Those of us who have looked to the self-interest of lending institutions to protect shareholders’ equity, myself included, are in a state of shocked disbelief,” Greenspan admitted to a House panel in 2008. That mea culpa was short-lived; he returns in his new book to an antipathy for regulation and a belief in the righteousness of the free market."

US CEOs break pay record as top 10 earners take home at least $100m each | Business | theguardian.com

US CEOs break pay record as top 10 earners take home at least $100m each

"For the first time ever, the 10 highest-paid chief executives in the US received more than $100m in compensation last year, and two took home billion-dollar paychecks, according to a leading annual survey of executive pay."

"All told, the top 10 CEOs in this year's poll took home over $4.7bn between them, and for the first time ever, none earned less than $100m.

"I have never seen anything like that," said Greg Ruel, GMI's senior research consultant and author of the report. "Usually we have a few CEOs at the $100m-plus level but never the entire top 10."

Father Seamus Finn, a corporate governance expert at Missionary Oblates of Mary Immaculate, said the numbers were "ridiculous".

"It's an amazing number. Who knows how compensation committees come up with them?"

Finn, who has campaigned against what he sees as excessive remuneration at companies including Goldman Sachs, said boards often argued that they would lose talent unless they paid top management huge sums.

"But I've seen no evidence of that," he said. "These huge pay deals are seldom linked to shareholder returns.""

"For the first time ever, the 10 highest-paid chief executives in the US received more than $100m in compensation last year, and two took home billion-dollar paychecks, according to a leading annual survey of executive pay."

"All told, the top 10 CEOs in this year's poll took home over $4.7bn between them, and for the first time ever, none earned less than $100m.

"I have never seen anything like that," said Greg Ruel, GMI's senior research consultant and author of the report. "Usually we have a few CEOs at the $100m-plus level but never the entire top 10."

Father Seamus Finn, a corporate governance expert at Missionary Oblates of Mary Immaculate, said the numbers were "ridiculous".

"It's an amazing number. Who knows how compensation committees come up with them?"

Finn, who has campaigned against what he sees as excessive remuneration at companies including Goldman Sachs, said boards often argued that they would lose talent unless they paid top management huge sums.

"But I've seen no evidence of that," he said. "These huge pay deals are seldom linked to shareholder returns.""

Sunday, October 20, 2013

4 in 5 in USA face near-poverty, no work

4 in 5 in USA face near-poverty, no work

"Four out of 5 U.S. adults struggle with joblessness, near-poverty or reliance on welfare for at least parts of their lives, a sign of deteriorating economic security and an elusive American dream."

"Hardship is particularly growing among whites, based on several measures. Pessimism among that racial group about their families' economic futures has climbed to the highest point since at least 1987. In the most recent AP-GfK poll, 63% of whites called the economy "poor.""

"The gauge defines "economic insecurity" as a year or more of periodic joblessness, reliance on government aid such as food stamps or income below 150% of the poverty line. Measured across all races, the risk of economic insecurity rises to 79%."

:

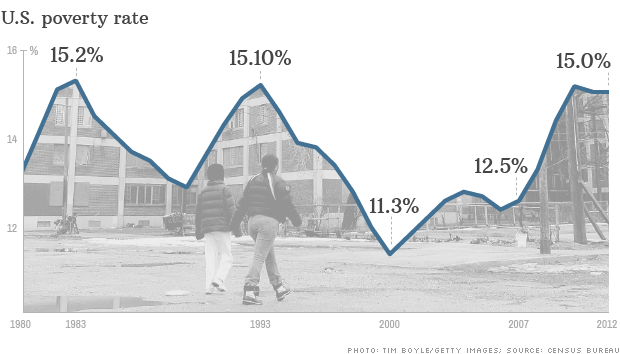

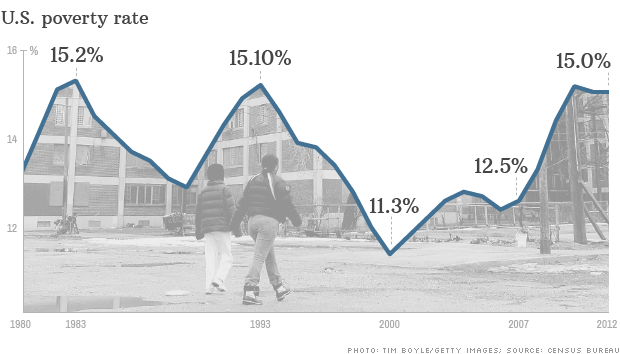

"Nationwide, the count of America's poor remains stuck at a record number: 46.2 million, or 15% of the population, due in part to lingering high unemployment following the recession. While poverty rates for blacks and Hispanics are nearly three times higher, by absolute numbers the predominant face of the poor is white.

More than 19 million whites fall below the poverty line of $23,021 for a family of four, accounting for more than 41% of the nation's destitute, nearly double the number of poor blacks."

"In 2011, that snapshot showed 12.6% of adults in their prime working-age years of 25-60 lived in poverty. But measured in terms of a person's lifetime risk, a much higher number — 4 in 10 adults — falls into poverty for at least a year of their lives.

The risks of poverty also have been increasing in recent decades, particularly among people ages 35-55, coinciding with widening income inequality. For instance, people ages 35-45 had a 17% risk of encountering poverty during the 1969-1989 time period; that risk increased to 23% during the 1989-2009 period. For those ages 45-55, the risk of poverty jumped from 11.8% to 17.7%.

Higher recent rates of unemployment mean the lifetime risk of experiencing economic insecurity now runs even higher: 79%, or 4 in 5 adults, by the time they turn 60.

By race, nonwhites still have a higher risk of being economically insecure, at 90 percent. But compared with the official poverty rate, some of the biggest jumps under the newer measure are among whites, with more than 76% enduring periods of joblessness, life on welfare or near-poverty.

By 2030, based on the current trend of widening income inequality, close to 85% of all working-age adults in the U.S. will experience bouts of economic insecurity."

"Four out of 5 U.S. adults struggle with joblessness, near-poverty or reliance on welfare for at least parts of their lives, a sign of deteriorating economic security and an elusive American dream."

"Hardship is particularly growing among whites, based on several measures. Pessimism among that racial group about their families' economic futures has climbed to the highest point since at least 1987. In the most recent AP-GfK poll, 63% of whites called the economy "poor.""

"The gauge defines "economic insecurity" as a year or more of periodic joblessness, reliance on government aid such as food stamps or income below 150% of the poverty line. Measured across all races, the risk of economic insecurity rises to 79%."

:

"Nationwide, the count of America's poor remains stuck at a record number: 46.2 million, or 15% of the population, due in part to lingering high unemployment following the recession. While poverty rates for blacks and Hispanics are nearly three times higher, by absolute numbers the predominant face of the poor is white.

More than 19 million whites fall below the poverty line of $23,021 for a family of four, accounting for more than 41% of the nation's destitute, nearly double the number of poor blacks."

"In 2011, that snapshot showed 12.6% of adults in their prime working-age years of 25-60 lived in poverty. But measured in terms of a person's lifetime risk, a much higher number — 4 in 10 adults — falls into poverty for at least a year of their lives.

The risks of poverty also have been increasing in recent decades, particularly among people ages 35-55, coinciding with widening income inequality. For instance, people ages 35-45 had a 17% risk of encountering poverty during the 1969-1989 time period; that risk increased to 23% during the 1989-2009 period. For those ages 45-55, the risk of poverty jumped from 11.8% to 17.7%.